Early Sign-Up Discounts: Planning Ahead

Why Early Sign-Up Matters Insurance Discounts for Teen Drivers

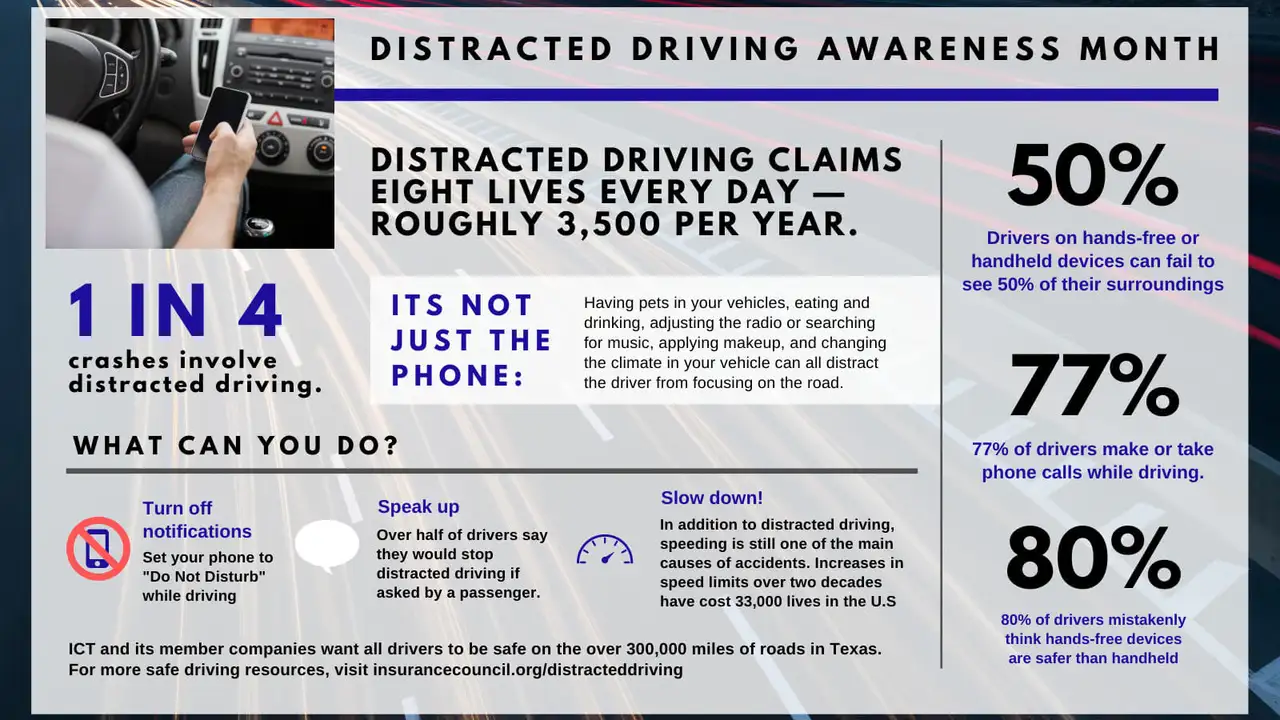

Okay, so you're a teen driver, or maybe you're the parent of one. Either way, insurance is a must-have, but it can feel like a huge drain on the wallet. That's where early sign-up discounts come in. Think of it like this: insurance companies love predictability. If you're proactive and start looking into insurance before you even have your license, you're showing them you're responsible. And responsible drivers get rewarded! It's all about risk assessment, and early planning signals lower risk.

The Advantage of Starting Early Insurance Quote Comparison

The biggest perk? You get to compare rates and policies without the pressure of needing coverage right now. This means you can shop around for the best deal, understand the different types of coverage available (liability, collision, comprehensive – we'll get to those later!), and potentially snag a discount just for being prepared. Plus, you have time to ask all those "dumb" questions you might be too embarrassed to ask when you're in a rush. No question is dumb when it comes to protecting yourself and your car!

Specific Insurance Products and Early Sign-Up Programs Teen Driver Coverage

Let's talk specifics. Many major insurance companies offer early sign-up programs. Here are a few examples:

- State Farm's Steer Clear Program: This program is more about safe driving habits than early sign-up, but completing the program can lead to significant discounts. It's an app-based program that tracks driving behavior and provides feedback. Think of it as a video game, but instead of leveling up a character, you're leveling up your driving skills and saving money! It works best for new drivers in their first few years of driving.

- Allstate's Good Student Discount: While not explicitly an "early sign-up" discount, maintaining good grades (usually a B average or better) often qualifies you for a discount. Start focusing on your grades early, and you'll be rewarded in more ways than one! This discount is best suited for students who excel academically.

- Progressive's Snapshot Program: This program uses a device (or app) to track your driving habits, like speed, braking, and time of day. Safe driving habits lead to discounts. Even before you have your license, you can research safe driving practices and familiarize yourself with the rules of the road. This program is ideal for drivers who are confident in their ability to drive safely and consistently.

Comparing Insurance Products Features and Prices for Teen Drivers

Okay, let's dive deeper into comparing these options. State Farm's Steer Clear focuses on improving driving habits through real-time feedback, making it a proactive choice. Allstate's Good Student discount is straightforward – good grades, good discount. Progressive's Snapshot is data-driven, rewarding safe driving behaviors. The "best" option really depends on your individual circumstances and driving style.

Price Considerations: The actual discount amount varies depending on the company, your location, your driving record (or lack thereof!), and the type of coverage you choose. Generally, discounts can range from 5% to 25% or even more. It's crucial to get quotes from multiple companies and compare the total cost, not just the discount percentage.

Usage Scenarios: Imagine you're a parent. Your teen is about to get their permit. You start researching insurance options now. You discover State Farm's Steer Clear and decide to enroll your teen as soon as they're eligible. This shows the insurance company you're taking proactive steps to ensure your teen is a safe driver. Or, maybe your teen is a straight-A student. You focus on maintaining those grades, knowing that Allstate's Good Student discount will help lower your insurance premiums.

Understanding Insurance Coverage Types Liability, Collision, and Comprehensive

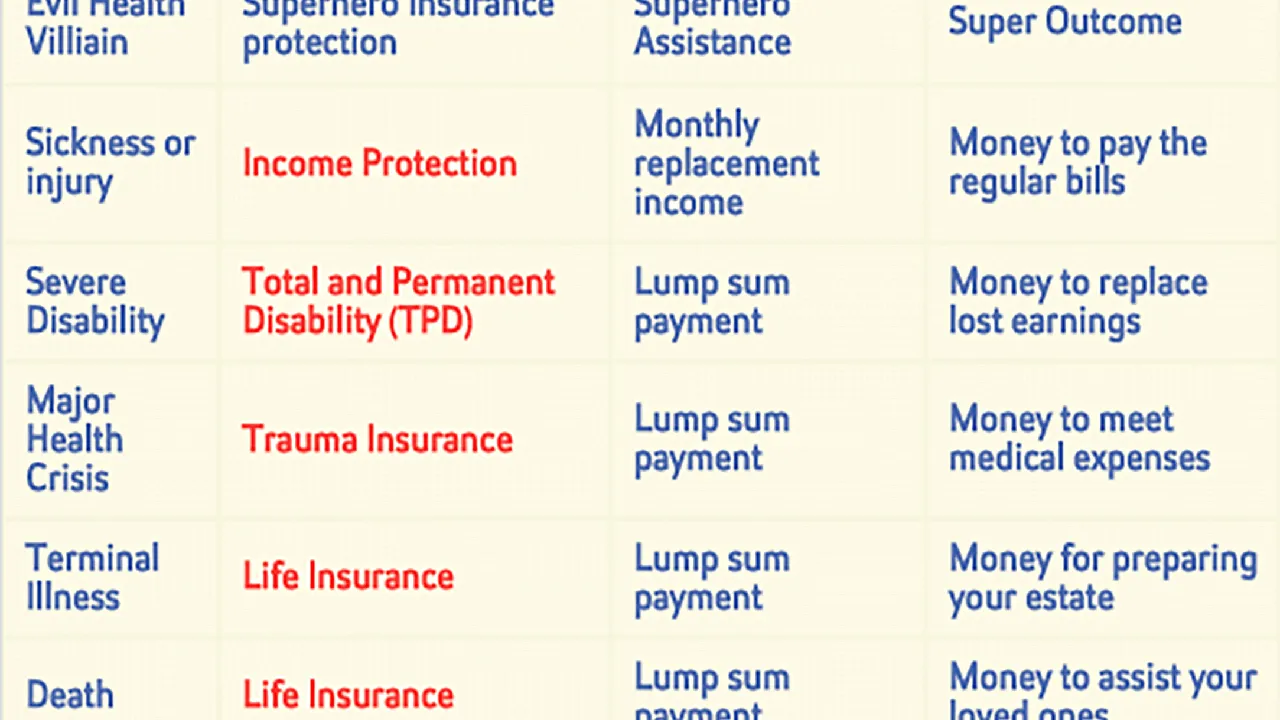

Before you get too caught up in discounts, it's essential to understand the different types of coverage. Liability coverage protects you if you cause an accident and injure someone else or damage their property. It's usually the minimum coverage required by law. Collision coverage pays for damage to your car if you hit another vehicle or object, regardless of who's at fault. Comprehensive coverage covers damage to your car from things like theft, vandalism, fire, or natural disasters (like hail or a falling tree). Consider your needs and budget when choosing your coverage levels.

Beyond Early Sign-Up Other Insurance Discounts for Teen Drivers

Early sign-up is just one piece of the puzzle. Other potential discounts include:

- Good Student Discount: As mentioned earlier, good grades are a major plus.

- Driver's Education Discount: Completing a driver's education course demonstrates a commitment to safe driving.

- Multi-Policy Discount: If you bundle your auto insurance with other policies (like home or renters insurance), you may qualify for a discount.

- Vehicle Safety Features Discount: Cars with safety features like anti-lock brakes, airbags, and electronic stability control may qualify for a discount.

Practical Tips for Finding the Best Insurance Deal for Teen Drivers

Here's a quick rundown of how to find the best deal:

- Start early: Begin researching insurance options well before your teen gets their license.

- Shop around: Get quotes from multiple insurance companies. Don't just settle for the first quote you receive.

- Compare coverage levels: Make sure you're comparing apples to apples. Consider the deductible, liability limits, and other coverage options.

- Ask about discounts: Don't be afraid to ask about all available discounts.

- Read the fine print: Understand the terms and conditions of your policy before you sign up.

Real-World Insurance Scenarios and Teen Driver Discounts

Let's say your teen gets into a minor fender bender (hopefully not!). Having adequate liability coverage will protect you from potentially devastating financial consequences. Or, if your car is stolen (knock on wood!), comprehensive coverage will help you replace it. Insurance is about peace of mind, knowing you're protected in case the unexpected happens.

Budgeting for Teen Driver Insurance Making Informed Decisions

Insurance can be expensive, but it's a necessary expense. Talk to your teen about the cost of insurance and involve them in the decision-making process. This can help them understand the importance of safe driving and responsible financial planning. Maybe they can contribute to the insurance payments, which can further encourage safe driving habits.

Future Trends in Teen Driver Insurance Technology and Discounts

The future of teen driver insurance is likely to be heavily influenced by technology. Telematics (like Progressive's Snapshot) will become even more sophisticated, providing more detailed insights into driving behavior. Self-driving cars may eventually eliminate the need for teen driver insurance altogether, but that's still a long way off! For now, focusing on safe driving habits and exploring all available discounts is the best way to keep insurance costs down.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)