Anti-Theft Device Discounts: Protecting Your Vehicle

Understanding Anti Theft Devices and Insurance Discounts for Teen Drivers

Hey there, future safe driver! So you're looking into getting some sweet discounts on your car insurance as a teen driver? Smart move! One of the best ways to do that is by installing anti-theft devices. Insurance companies love these things because they make your car less likely to get stolen, which means they're less likely to have to pay out a claim. It's a win-win! Let's dive into how these devices work and how they can save you some serious cash.

Types of Anti Theft Devices That Qualify for Insurance Discounts

Okay, so what exactly are we talking about when we say "anti-theft devices"? There's a whole range of options, from the super simple to the incredibly high-tech. Let's break down some of the most common ones:

- Car Alarms: These are the classic! They're loud, annoying (for thieves, anyway), and pretty effective. When someone tries to break into your car, the alarm goes off, hopefully scaring them away.

- Steering Wheel Locks: Think of these as a physical barrier. They lock your steering wheel in place, making it impossible to steer the car. It's a visible deterrent that can make a thief think twice.

- Kill Switches: This is where things get a little more technical. A kill switch cuts off the power to your car's engine, making it impossible to start. It's a hidden switch that only you know about.

- GPS Tracking Devices: These are the James Bond gadgets of the anti-theft world. They use GPS to track your car's location, so if it does get stolen, you can tell the police exactly where it is.

- Vehicle Immobilizers: These prevent the car from starting unless the correct key or transponder is used. They are often factory-installed, but aftermarket options are also available.

- Window Etching: Etching your VIN (Vehicle Identification Number) onto your windows makes your car less attractive to thieves because it's harder to resell.

Specific Anti Theft Product Recommendations and Comparisons

Alright, now let's get down to the nitty-gritty. Here are a few specific products I'd recommend, along with their pros, cons, typical use cases, and price ranges:

The Club 3000 Twin Hooks Steering Wheel Lock

Description: This is a super popular steering wheel lock known for its bright color and sturdy construction. It physically prevents the steering wheel from turning.

Pros: Highly visible deterrent, relatively inexpensive, easy to install.

Cons: Can be defeated with the right tools (though it takes time and effort), can be bulky to store.

Use Case: Great for parking in high-crime areas or overnight. Perfect for adding a visible layer of security.

Price: Around $30-$50.

Viper 31000 Car Alarm System

Description: A basic but reliable car alarm system. It features a loud siren and a shock sensor that triggers the alarm if someone tries to break in.

Pros: Relatively affordable, offers good basic protection, loud siren can deter thieves.

Cons: May require professional installation, can be prone to false alarms if not adjusted properly.

Use Case: Suitable for most vehicles, especially those parked in areas with moderate theft risk.

Price: Around $80-$150 (plus installation costs).

Ravelco Anti Theft Device (Kill Switch)

Description: This is a more sophisticated kill switch system. It uses a unique plug that must be inserted into the dashboard to allow the car to start. Without the plug, the car is completely immobilized.

Pros: Highly effective, difficult to bypass, doesn't rely on batteries or remote controls.

Cons: More expensive than other options, requires professional installation, you need to keep track of the plug.

Use Case: Excellent for high-value vehicles or those parked in areas with high theft rates. Provides a high level of security.

Price: Around $500-$800 (including installation).

Apple AirTag (GPS Tracker Alternative)

Description: While not specifically designed as an anti-theft device, an Apple AirTag can be hidden in your car to provide a basic level of tracking. It uses Apple's Find My network to report its location.

Pros: Inexpensive, easy to set up, wide network coverage (if you're in an area with lots of Apple users).

Cons: Not as precise as a dedicated GPS tracker, relies on other Apple devices to report its location, thieves may be able to find and remove it.

Use Case: A budget-friendly option for basic tracking. Can be used in conjunction with other anti-theft devices.

Price: Around $29.

Dedicated GPS Tracking Device - Optimus 2.0

Description: A dedicated GPS tracker that provides real-time location tracking and geofencing capabilities. You can set up alerts if your car moves outside a designated area.

Pros: Accurate tracking, real-time alerts, can be hidden easily, subscription-based service often includes historical data.

Cons: Requires a monthly subscription, needs to be charged or wired to the car's power, more expensive upfront than an AirTag.

Use Case: Best for vehicles that are at high risk of theft or for parents who want to monitor their teen's driving habits.

Price: Device around $79, plus a monthly subscription fee (typically $20-30).

Installation Considerations for Anti Theft Devices

Okay, so you've picked out your devices. Now what? Some of these are super easy to install yourself. A steering wheel lock? Just slap it on! An AirTag? Hide it under a seat. But for things like car alarms, kill switches, and GPS trackers, you're probably going to want to get a professional to install them. Why? Because messing with your car's electrical system can be tricky, and you don't want to accidentally fry something important. Plus, a professional installer will know the best places to hide the devices and how to wire them correctly.

Comparing the Effectiveness of Different Anti Theft Systems

So, which anti-theft system is right for you? It really depends on your budget, your risk tolerance, and the type of car you have. A basic steering wheel lock and a car alarm might be enough for an older, less valuable car. But if you're driving a brand-new sports car, you're going to want to invest in something more sophisticated, like a kill switch or a GPS tracker. Consider this table:

| Device | Effectiveness | Cost | Installation |

|---|---|---|---|

| Steering Wheel Lock | Low-Medium | Low | Easy DIY |

| Car Alarm | Medium | Medium | Professional Recommended |

| Kill Switch | High | High | Professional Required |

| GPS Tracker | High | Medium-High (including subscription) | Professional Recommended |

| Window Etching | Low-Medium (Deters thieves, aids recovery) | Low | DIY or Professional |

How to Get Insurance Discounts with Anti Theft Devices

Alright, let's get to the good stuff: the discounts! Once you've installed your anti-theft devices, you'll need to let your insurance company know. They'll probably ask for proof of installation, such as a receipt from the installer or a copy of the device's warranty. Be sure to keep these documents handy! The amount of the discount will vary depending on the insurance company and the type of device you've installed. But generally, the more sophisticated the device, the bigger the discount.

Factors Affecting Insurance Discount Amount

Several factors play into how much you can save on your insurance premium by installing anti-theft devices. Here are a few key considerations:

- Type of Device: As mentioned, more advanced systems like GPS trackers and kill switches typically yield larger discounts compared to basic steering wheel locks.

- Insurance Company: Different insurance companies have different policies regarding anti-theft discounts. Some may offer a flat percentage discount, while others may have a tiered system based on the device's effectiveness. It's worth shopping around to see which insurer offers the best deal for your situation.

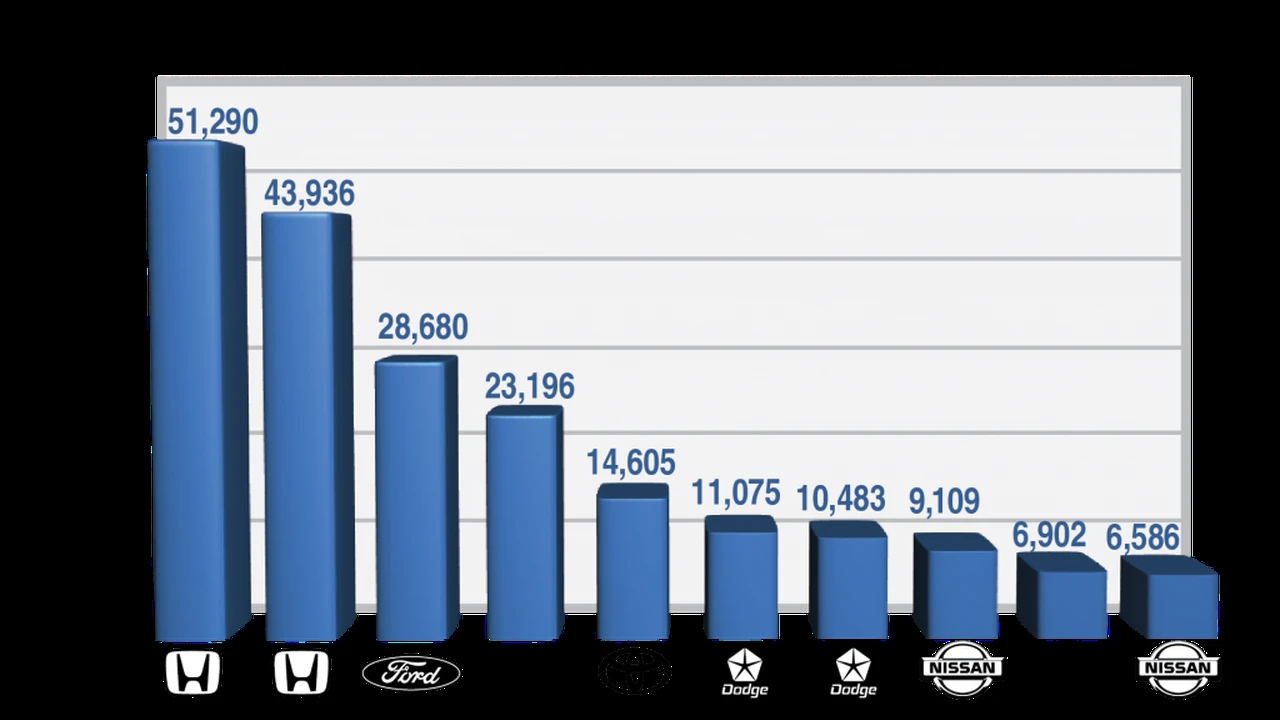

- Vehicle Type: The make and model of your car can also influence the discount amount. Vehicles that are statistically more likely to be stolen may qualify for larger discounts when equipped with anti-theft devices.

- Location: If you live in an area with a high rate of car theft, your insurance company may be more inclined to offer a significant discount for anti-theft measures.

- Policy Type: The type of insurance policy you have (e.g., comprehensive, liability) can also affect the discount. Comprehensive coverage, which covers theft, is more likely to be impacted by anti-theft devices than liability-only coverage.

Talking to Your Insurance Agent About Anti Theft Discounts

Don't be shy! Call your insurance agent and ask them about anti-theft discounts. They can tell you exactly what types of devices qualify and how much you can save. They can also help you understand the specific requirements of your insurance policy.

Beyond Discounts: The Peace of Mind Factor

While saving money is great, there's another big benefit to installing anti-theft devices: peace of mind. Knowing that your car is protected can help you sleep better at night and reduce stress. It's a small investment that can make a big difference in your overall well-being. So go ahead, protect your ride and your wallet! You got this!

Preventative Measures and Good Habits to Deter Theft

Installing anti-theft devices is a great start, but it's also important to practice good habits to deter theft in the first place. Here are a few simple tips:

- Always lock your doors: Even if you're just running into a store for a minute, always lock your doors. It's the easiest way to prevent a smash-and-grab.

- Park in well-lit areas: Thieves are less likely to target cars parked in well-lit areas with high visibility.

- Don't leave valuables in plain sight: Keep your phone, laptop, and other valuables out of sight. Put them in the trunk or under the seat.

- Be aware of your surroundings: Pay attention to your surroundings and be wary of anyone who seems suspicious.

- Consider a dashcam: A dashcam can record any attempted break-ins or thefts, providing valuable evidence for the police. Some dashcams even have parking mode, which records when the car is parked and unattended.

The Future of Anti Theft Technology

The world of anti-theft technology is constantly evolving. We're seeing more and more integration with smartphones and smart home systems. Imagine a system that automatically locks your car doors, arms the alarm, and sends you a notification if someone tries to break in – all controlled from your phone! Biometric security, like fingerprint scanners, is also becoming more common in high-end vehicles. And who knows what the future holds? Maybe we'll have cars that can automatically drive away from danger! The key is to stay informed and invest in the technology that best protects your vehicle and gives you peace of mind.

Understanding False Alarms and How to Prevent Them

One common complaint about car alarms is the issue of false alarms. A false alarm can be triggered by a variety of factors, such as a loud noise, a strong wind, or even a passing truck. Frequent false alarms can be annoying for you and your neighbors, and they can also desensitize people to the alarm, making them less likely to react if a real theft occurs.

Here are a few tips to prevent false alarms:

- Adjust the sensitivity of your alarm: Most car alarms have adjustable sensitivity settings. If you're experiencing frequent false alarms, try lowering the sensitivity.

- Park away from high-traffic areas: Parking near busy streets or construction sites can increase the likelihood of false alarms.

- Keep your car clean: Loose objects inside your car can trigger the alarm if they move around.

- Check your car battery: A weak car battery can sometimes cause false alarms.

- Consider a dual-zone alarm: Dual-zone alarms have separate sensors for the interior and exterior of the car. This can help to reduce false alarms caused by external factors.

Reviewing Your Insurance Policy Regularly

It's a good idea to review your insurance policy at least once a year to make sure it still meets your needs. As your circumstances change, your insurance needs may also change. For example, if you move to a new neighborhood, buy a new car, or add anti-theft devices, you may need to adjust your coverage.

During your policy review, be sure to:

- Check your coverage limits: Make sure your coverage limits are adequate to cover the cost of replacing your car if it's stolen or damaged.

- Update your information: Let your insurance company know if you've moved, changed your phone number, or added any drivers to your policy.

- Ask about discounts: Inquire about any new discounts that you may be eligible for, such as discounts for safe driving, good grades (for teen drivers), or anti-theft devices.

- Compare rates: Shop around to compare rates from different insurance companies. You may be able to find a better deal by switching insurers.

Protecting Yourself from Key Fob Hacking

Modern cars with keyless entry systems are vulnerable to a type of theft called key fob hacking. Thieves can use electronic devices to intercept the signal from your key fob and unlock your car. Here are a few ways to protect yourself from key fob hacking:

- Use a Faraday bag: A Faraday bag is a small pouch lined with metallic material that blocks radio waves. When you're not using your key fob, store it in a Faraday bag to prevent thieves from intercepting its signal.

- Turn off keyless entry at night: Some cars allow you to disable the keyless entry system at night. This can make it more difficult for thieves to hack your key fob.

- Be aware of your surroundings: Pay attention to your surroundings and be wary of anyone who seems to be following you or loitering near your car.

- Consider a steering wheel lock: Even if your car is vulnerable to key fob hacking, a steering wheel lock can still deter thieves.

The Importance of Proper Documentation and Reporting

If your car is stolen, it's important to take immediate action. First, report the theft to the police. They will create a police report, which you will need for your insurance claim. Be sure to provide the police with as much information as possible, including the car's VIN, license plate number, and any identifying features.

Next, contact your insurance company to file a claim. They will guide you through the claims process and let you know what documentation you need to provide. This may include the police report, your insurance policy, and proof of ownership.

Having proper documentation, such as your insurance policy and vehicle registration, can make the claims process much smoother and faster.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)