Comparing Insurance Quotes: Finding the Best Rates

Understanding the Importance of Comparing Teen Driver Insurance Quotes

Alright, let's be real. Teen driver insurance? It's expensive. Like, really expensive. But it doesn't have to break the bank. The key? Comparing insurance quotes. Think of it like shopping for anything else – you wouldn't buy the first TV you see, right? Same goes for insurance. You need to shop around to find the best rates. Why? Because insurance companies use different formulas to calculate your premiums. Factors like your teen's driving record (or lack thereof!), the type of car they drive, where you live, and even their grades can all impact the price. So, comparing quotes is the only way to see who's offering the best deal for your specific situation.

Factors Affecting Teen Driver Insurance Rates A Deep Dive

Okay, let's get into the nitty-gritty. What exactly makes teen driver insurance so pricey? Well, it's a combination of factors, mainly revolving around risk. Insurance companies see young, inexperienced drivers as a higher risk of accidents. Here's a breakdown:

- Driving Experience (or Lack Thereof): This is the big one. Teens simply haven't had the years behind the wheel to develop good driving habits and reflexes.

- Accident Statistics: Unfortunately, statistics show that teen drivers are more likely to be involved in accidents than older, more experienced drivers.

- Type of Vehicle: A sporty, high-powered car will cost more to insure than a sensible sedan. Why? Because the risk of speeding and reckless driving is higher.

- Location: If you live in a densely populated area with high traffic, your rates will likely be higher than if you live in a rural area.

- Coverage Levels: The more coverage you have, the more you'll pay. Liability coverage, collision coverage, comprehensive coverage – it all adds up.

- Credit Score (in some states): In some states, insurance companies can use your credit score to determine your rates. A lower credit score may result in higher premiums.

- Grades: Good grades can actually lower your insurance rates! Many companies offer discounts for students who maintain a certain GPA. It's an incentive to stay focused on school.

Where to Find Teen Driver Insurance Quotes Online and Offline Options

Alright, so you're ready to start comparing quotes. Where do you even begin? You've got options, both online and offline. Let's break them down:

- Online Insurance Comparison Websites: These websites allow you to enter your information once and receive quotes from multiple insurance companies. It's a quick and easy way to get a general idea of what's out there. Examples include:

- QuoteWizard: A popular option known for its user-friendly interface and wide range of participating insurers.

- The Zebra: Offers detailed comparisons and helpful articles to guide you through the process.

- Compare.com: Another solid option with a focus on saving you time and money.

- Direct Insurance Company Websites: You can also go directly to the websites of individual insurance companies and request a quote. This can be more time-consuming, but it allows you to get a more accurate quote based on your specific needs. Think of companies like:

- State Farm: Known for its extensive network of agents and comprehensive coverage options.

- Geico: A popular choice for its competitive rates and easy online quote process.

- Progressive: Offers a variety of discounts and coverage options to suit different needs.

- Independent Insurance Agents: These agents work with multiple insurance companies and can help you find the best coverage at the best price. They can provide personalized advice and guidance.

- Captive Insurance Agents: These agents work for a single insurance company and can only offer products from that company. While they may not be able to offer as many options as independent agents, they can provide in-depth knowledge of their company's products.

The Step by Step Process of Getting and Comparing Insurance Quotes

Okay, let's walk through the process of actually getting and comparing insurance quotes:

- Gather Your Information: Before you start, you'll need to gather some information about your teen driver, including their driver's license number, vehicle information (make, model, year), driving history (if any), and social security number (for verification purposes). You'll also need your own information, such as your address and date of birth.

- Choose Your Method: Decide whether you want to use an online comparison website, go directly to insurance company websites, or work with an insurance agent.

- Enter Your Information: Carefully and accurately enter all of the required information. Be honest about your teen's driving history, as any inaccuracies could lead to problems later on.

- Review Your Quotes: Once you've received your quotes, take the time to carefully review them. Pay attention to the coverage levels, deductibles, and premiums. Don't just focus on the price – make sure you're getting the coverage you need.

- Compare Apples to Apples: Make sure you're comparing quotes for the same coverage levels and deductibles. Otherwise, you're not getting an accurate comparison.

- Look for Discounts: Many insurance companies offer discounts for things like good grades, safe driving courses, and multiple vehicles insured under the same policy. Be sure to ask about any discounts that may apply to you.

- Read the Fine Print: Before you commit to a policy, be sure to read the fine print. Understand what's covered and what's not.

- Ask Questions: If you have any questions, don't hesitate to ask the insurance company or agent. It's important to understand your policy before you sign up.

Key Features to Consider When Comparing Insurance Policies

It's not just about the price! Here are some key features to consider when comparing insurance policies:

- Coverage Levels: How much coverage do you need? Liability coverage protects you if your teen driver causes an accident and injures someone else or damages their property. Collision coverage pays for damage to your vehicle if it's involved in an accident, regardless of who's at fault. Comprehensive coverage protects your vehicle from things like theft, vandalism, and natural disasters.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance company pays the rest. A higher deductible will result in a lower premium, but you'll have to pay more if you have an accident. A lower deductible will result in a higher premium, but you'll pay less if you have an accident.

- Policy Limits: Policy limits are the maximum amount your insurance company will pay out in the event of an accident. Make sure your policy limits are high enough to protect you from financial ruin.

- Discounts: As mentioned earlier, many insurance companies offer discounts for things like good grades, safe driving courses, and multiple vehicles insured under the same policy.

- Customer Service: How responsive and helpful is the insurance company's customer service? You want to be able to reach them easily if you have questions or need to file a claim.

- Financial Stability: Is the insurance company financially stable? You want to make sure they'll be able to pay out your claim if you have an accident. You can check an insurance company's financial rating with agencies like A.M. Best.

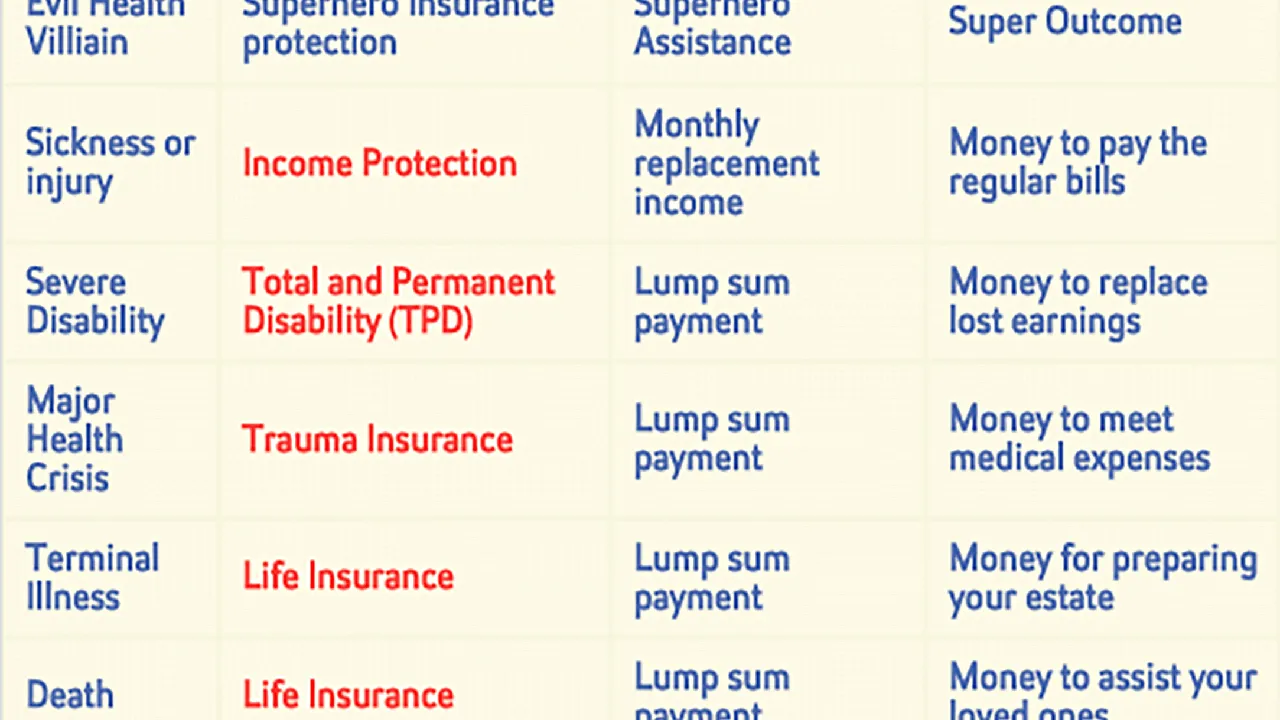

Specific Insurance Products and Their Use Cases

Let's look at some specific insurance products and how they might be used in different situations:

- Usage-Based Insurance (UBI): Also known as pay-as-you-drive insurance, UBI uses telematics to track your teen's driving habits. The safer they drive, the lower their rates will be. This can be a great option if your teen is a responsible driver. Companies like Progressive (Snapshot) and State Farm (Drive Safe & Save) offer UBI programs. Pricing: Typically, a device is provided free of charge, and discounts are applied based on driving data. Savings can range from 5% to 30% or more.

- Defensive Driving Courses: Many insurance companies offer discounts for teens who complete a defensive driving course. These courses teach teens how to drive safely and avoid accidents. The National Safety Council and AAA offer defensive driving courses. Pricing: Courses typically range from $50 to $150. The insurance discount usually lasts for 3 years.

- Adding Your Teen to Your Existing Policy: This is often the most affordable option, as you'll be able to take advantage of multi-car discounts. However, it's important to make sure your policy limits are high enough to cover your teen driver.

- Standalone Teen Driver Insurance Policy: This can be a good option if you don't want your teen's driving record to affect your own insurance rates. However, it's typically more expensive than adding your teen to your existing policy.

Comparing Specific Insurance Companies and Their Pricing

Let's compare some specific insurance companies and their pricing for teen drivers. Keep in mind that these are just estimates, and your actual rates may vary depending on your individual circumstances:

- State Farm: Known for its comprehensive coverage and strong customer service. Estimated annual premium for a teen driver: $2,500 - $4,000.

- Geico: A popular choice for its competitive rates and easy online quote process. Estimated annual premium for a teen driver: $2,000 - $3,500.

- Progressive: Offers a variety of discounts and coverage options to suit different needs. Estimated annual premium for a teen driver: $1,800 - $3,200.

- Allstate: Another major insurance company with a wide range of coverage options. Estimated annual premium for a teen driver: $2,200 - $3,800.

Disclaimer: These are just estimated prices. Actual rates can vary significantly based on individual circumstances. Always get a personalized quote from multiple insurance companies to find the best rates for your specific situation.

The Long Term Benefits of Safe Driving Habits for Teenagers

Investing in safe driving habits for your teenager isn't just about saving money on insurance. It's about their safety and the safety of others on the road. Encouraging safe driving habits from the beginning can have long-term benefits, including:

- Reduced Risk of Accidents: Safe driving habits significantly reduce the risk of accidents, protecting your teen from injury or even death.

- Lower Insurance Rates in the Future: A clean driving record will result in lower insurance rates for years to come.

- Increased Confidence: Safe driving habits can increase your teen's confidence behind the wheel.

- Responsible Behavior: Encouraging safe driving habits teaches your teen to be a responsible and conscientious driver.

Negotiating Lower Rates with Insurance Companies Pro Tips

Don't be afraid to negotiate with insurance companies! Here are some pro tips for getting lower rates:

- Ask for Discounts: Don't be shy about asking for discounts. Many insurance companies offer discounts that they don't automatically apply.

- Bundle Your Policies: If you have multiple insurance policies (e.g., auto, home), consider bundling them with the same company for a discount.

- Increase Your Deductible: Increasing your deductible will lower your premium, but make sure you can afford to pay the higher deductible if you have an accident.

- Shop Around Regularly: Don't just stick with the same insurance company year after year. Shop around regularly to see if you can find a better deal elsewhere.

- Improve Your Credit Score: In some states, insurance companies can use your credit score to determine your rates. Improving your credit score can result in lower premiums.

- Install Safety Features: Installing safety features in your vehicle, such as anti-theft devices or lane departure warning systems, can sometimes qualify you for a discount.

- Consider a Higher Coverage Limit: While it may seem counterintuitive, sometimes increasing your coverage limit can actually lower your rates. This is because insurance companies may offer discounts for higher coverage levels.

Common Mistakes to Avoid When Comparing Insurance Quotes

Here are some common mistakes to avoid when comparing insurance quotes:

- Not Comparing Apples to Apples: Make sure you're comparing quotes for the same coverage levels and deductibles.

- Focusing Only on Price: Don't just focus on the price. Consider the coverage levels, customer service, and financial stability of the insurance company.

- Not Reading the Fine Print: Be sure to read the fine print before you commit to a policy. Understand what's covered and what's not.

- Not Asking Questions: If you have any questions, don't hesitate to ask the insurance company or agent.

- Underestimating Your Coverage Needs: Make sure you have enough coverage to protect you from financial ruin in the event of an accident.

- Providing Inaccurate Information: Be honest about your teen's driving history and other relevant information. Inaccurate information could lead to problems later on.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)