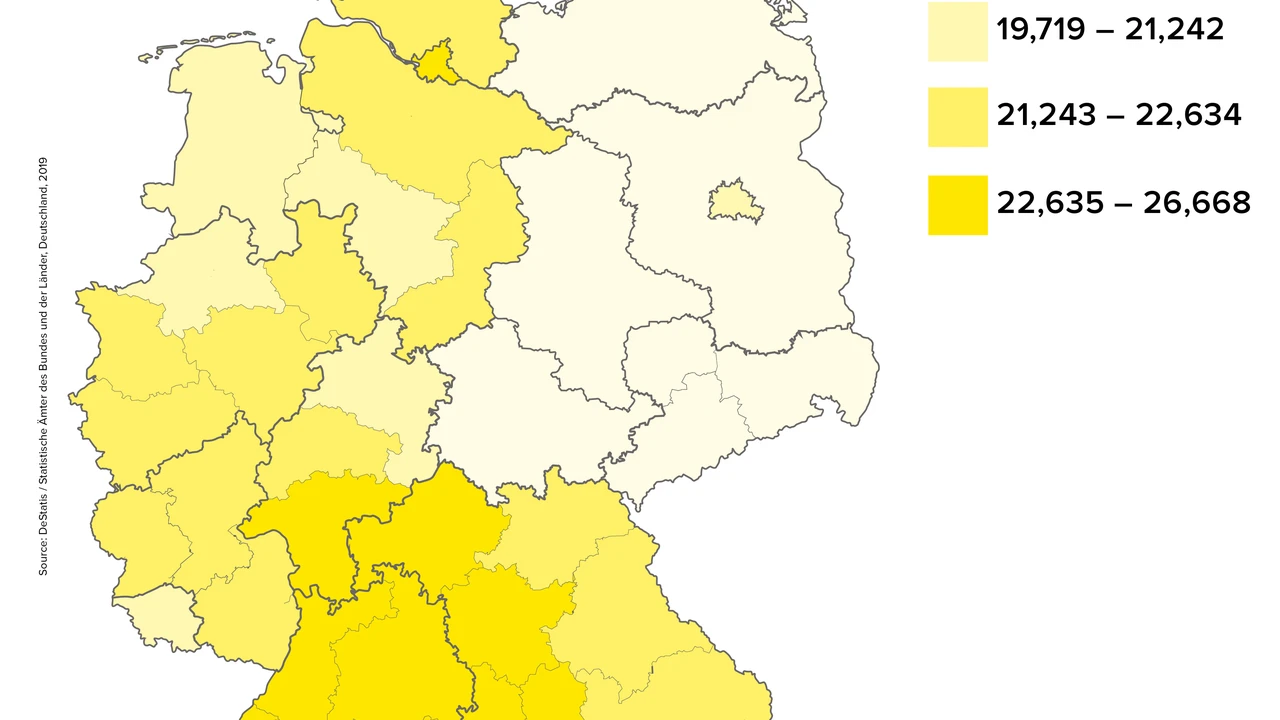

Discount Availability by State: Regional Differences

Navigating Teen Driver Insurance Discounts State by State A Regional Overview

Alright, so you're trying to save some serious cash on your teen driver's insurance. Smart move! Insurance premiums for young drivers can be, well, let's just say they're not exactly budget-friendly. One of the biggest factors influencing those premiums is where you live. Discount availability varies wildly from state to state, so let's dive into the regional differences and how they impact your wallet.

Understanding State Regulations and Teen Driver Insurance Policies

First things first, each state has its own set of rules and regulations regarding insurance. This includes the types of discounts insurers are required (or allowed) to offer. Some states are more proactive in promoting safe driving habits and incentivizing lower rates for teens who meet certain criteria. Others... not so much.

For example, some states mandate that insurers offer a good student discount if a teen maintains a certain GPA. Others might have specific requirements for driver's education courses or supervised driving hours that unlock discounts. Knowing your state's specific regulations is crucial to maximizing your savings.

The Northeast High Premiums and Limited Discounts

The Northeast, generally speaking, tends to have higher insurance rates overall. This is due to a combination of factors, including higher population density, more frequent accidents in urban areas, and state-specific insurance laws. Unfortunately, the availability of teen driver discounts in this region can be somewhat limited compared to other parts of the country.

While you'll still find standard discounts like good student discounts and driver's education discounts, you might not see as many innovative or state-sponsored programs aimed at reducing teen driver premiums. States like Massachusetts, New York, and Pennsylvania often have stricter regulations that can limit the flexibility of insurers to offer discounts.

The South More Options but Higher Accident Rates

The South presents a mixed bag. Some southern states have more relaxed regulations, allowing insurers to offer a wider range of discounts. However, accident rates in certain areas can be higher, which can offset some of the potential savings. States like Texas, Florida, and Georgia often have a higher number of uninsured drivers, which can also impact premiums.

You'll likely find discounts for things like defensive driving courses, telematics programs (where the insurer monitors driving behavior), and even discounts for simply adding your teen to an existing policy. However, be prepared to shop around and compare quotes, as rates can vary significantly between insurers.

The Midwest A Sweet Spot for Discounts and Lower Rates

The Midwest often offers a more favorable combination of lower overall insurance rates and a decent selection of discounts. States like Illinois, Ohio, and Michigan tend to have more affordable premiums than the coastal regions, and you'll still find many of the standard discounts available.

Keep an eye out for discounts related to vehicle safety features, such as anti-lock brakes, electronic stability control, and airbags. Some insurers also offer discounts for teens who participate in community service or volunteer activities.

The West Coast Innovation and Tech-Driven Discounts

The West Coast, particularly California, is known for its innovative approach to insurance. You'll find a greater emphasis on technology-driven discounts, such as telematics programs that use smartphone apps or in-car devices to track driving behavior. These programs can offer significant savings for safe drivers.

California also has a good student discount and offers discounts for completing driver's education. Washington and Oregon also have similar options, though discount availability can still vary. The focus is often on rewarding safe driving habits and using technology to monitor and improve performance.

Good Student Discounts Maximizing Academic Achievements for Insurance Savings

This is a classic for a reason! Almost every major insurer offers a good student discount. The specifics vary, but generally, you'll need to maintain a B average (3.0 GPA) or higher. Some insurers also accept proof of honor roll status or a certain score on standardized tests. Make sure to have those report cards ready!

Driver's Education Discounts The Value of Formal Training

Completing a state-approved driver's education course can unlock significant savings. This not only teaches your teen the fundamentals of safe driving but also demonstrates to the insurer that they're taking their responsibility seriously. Check with your local DMV for a list of approved courses.

Telematics Programs Usage-Based Insurance for Teen Drivers

These programs, often using smartphone apps or in-car devices, track your teen's driving behavior, including speed, braking, and acceleration. Safe driving habits are rewarded with discounts. It's a great way to encourage responsible driving and save money simultaneously. Be aware that aggressive driving can increase your rates, so transparency and clear communication with your teen is key.

Defensive Driving Courses Enhancing Skills and Reducing Risk

Taking a defensive driving course goes beyond basic driver's education. It teaches advanced techniques for avoiding accidents and handling challenging driving situations. Many insurers offer discounts for completing these courses, and some states even allow you to reduce points on your driving record.

Multi-Policy Discounts Bundling Insurance for Maximum Savings

If you already have your home or auto insurance with a particular company, adding your teen's policy can often qualify you for a multi-policy discount. This is a simple way to save money without having to change insurers.

Vehicle Safety Feature Discounts Investing in Safety for Lower Premiums

Cars equipped with advanced safety features, such as anti-lock brakes, electronic stability control, and airbags, are often eligible for discounts. These features reduce the risk of accidents and injuries, which translates to lower insurance costs.

Comparing Insurance Products for Teen Drivers Key Features and Pricing

Okay, let's talk products! Here are a few examples of insurance companies known for offering competitive rates and comprehensive coverage for teen drivers:

State Farm Drive Safe & Save

State Farm's Drive Safe & Save program is a telematics-based option that uses a smartphone app to track driving behavior. It offers personalized feedback and rewards safe driving with discounts of up to 30%. It's a good option for teens who are confident in their driving abilities and willing to be monitored. The base price for a teen driver's policy (added to a parent's existing policy) might start around $150/month, but can be significantly lower with the Drive Safe & Save discount.

Usage Scenario: Ideal for teens who commute to school or work and consistently practice safe driving habits.

Pros: Significant potential savings, personalized feedback, promotes safe driving.

Cons: Requires constant app usage, aggressive driving can increase rates, privacy concerns for some.

Allstate Drivewise

Similar to State Farm's program, Allstate Drivewise uses a smartphone app to track driving behavior. It offers a slightly different approach, providing immediate feedback after each trip and awarding points that can be redeemed for rewards. The discount potential is also substantial, potentially reducing premiums by up to 25%. A teen driver's policy with Allstate might start around $175/month, but Drivewise can bring it down.

Usage Scenario: Suitable for teens who want immediate feedback on their driving and are motivated by rewards.

Pros: Immediate feedback, reward system, potential for significant savings.

Cons: Requires consistent app usage, potential for rate increases based on driving behavior, reward system might not appeal to everyone.

Progressive Snapshot

Progressive Snapshot offers a slightly different approach. You can choose to use a plug-in device or a smartphone app to track your driving. The discounts are based on your actual driving habits, with safer drivers earning the biggest savings. Progressive is generally known for competitive rates, and Snapshot can make them even more attractive. Initial quotes for teen drivers with Progressive can be around $160/month, but the Snapshot discount can drastically change that.

Usage Scenario: A good choice for teens who prefer flexibility in tracking their driving (device or app) and want transparent pricing based on their actual driving habits.

Pros: Flexible tracking options, transparent pricing, potential for significant savings.

Cons: Requires consistent tracking, potential for rate increases based on driving behavior, some find the plug-in device intrusive.

Geico DriveEasy

Geico DriveEasy is a newer telematics program that focuses on rewarding good driving habits with discounts. It tracks things like hard braking, speeding, and distracted driving. Geico often has competitive base rates, and DriveEasy can make them even more appealing. A teen driver's policy could start around $140/month, before any discounts.

Usage Scenario: Best for teens who are confident in their safe driving skills and want a straightforward way to earn discounts.

Pros: Straightforward approach, potential for discounts, competitive base rates.

Cons: Requires consistent tracking via the app, potential for rate increases, limited features compared to some other programs.

Product Comparison A Quick Guide

Here's a quick comparison of the products mentioned above:

| Product | Tracking Method | Discount Potential | Key Features | Price (Estimated) |

|---|---|---|---|---|

| State Farm Drive Safe & Save | Smartphone App | Up to 30% | Personalized feedback, promotes safe driving | $150/month (before discount) |

| Allstate Drivewise | Smartphone App | Up to 25% | Immediate feedback, reward system | $175/month (before discount) |

| Progressive Snapshot | Plug-in Device or Smartphone App | Variable, based on driving habits | Flexible tracking, transparent pricing | $160/month (before discount) |

| Geico DriveEasy | Smartphone App | Variable, based on driving habits | Straightforward approach, competitive base rates | $140/month (before discount) |

Note: Prices are estimates and can vary based on individual factors.

Shopping Around The Key to Finding the Best Deal

Don't settle for the first quote you receive! Shop around and compare rates from multiple insurers. Online comparison tools can be helpful, but it's also worth contacting local agents for personalized advice. Be sure to ask about all available discounts and how they apply to your specific situation.

Understanding Policy Coverage Types of Insurance and Their Importance

While saving money is important, don't sacrifice adequate coverage. Make sure your policy includes sufficient liability coverage to protect you from financial losses in case of an accident. Consider adding collision and comprehensive coverage to protect your vehicle from damage or theft. Uninsured/underinsured motorist coverage is also crucial, especially in states with a high number of uninsured drivers.

The Importance of Open Communication Talking to Your Teen About Safe Driving

Ultimately, the best way to save money on teen driver insurance is to promote safe driving habits. Talk to your teen about the dangers of distracted driving, speeding, and driving under the influence. Set clear expectations and enforce consequences for unsafe behavior. Consider signing a parent-teen driving agreement that outlines the rules and responsibilities.

Beyond Discounts Other Ways to Save on Teen Driver Insurance

Besides discounts, there are other strategies you can use to lower your teen driver's insurance costs. Consider increasing the deductible, which will lower your premiums but require you to pay more out-of-pocket in case of an accident. You can also explore the possibility of excluding your teen from driving certain vehicles, which can reduce the overall risk and lower your rates.

The Long Game Building a Positive Driving Record

Remember that your teen's driving record will impact their insurance rates for years to come. Encourage them to maintain a clean driving record by avoiding accidents, traffic violations, and other incidents. As they gain experience and demonstrate responsible driving habits, their rates will gradually decrease.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)