Teen Driver Insurance in Colorado: A Comprehensive Overview

Understanding Teen Driver Insurance Colorado Requirements

So, you're a teen in Colorado, or maybe you're the parent of one, and you're diving into the world of car insurance. Let's be real, it can seem like a maze. Colorado has specific rules and regulations when it comes to teen drivers and insurance. Knowing these rules is the first step to getting covered without breaking the bank.

First things first, Colorado requires all drivers to carry minimum liability coverage. This includes:

- $25,000 for bodily injury or death to one person in an accident

- $50,000 for bodily injury or death to all persons in an accident

- $15,000 for property damage in an accident

Now, while these are the minimums, it's often wise to consider higher limits. Why? Because if you're at fault in an accident and the damages exceed your coverage, you're personally responsible for paying the difference. And trust me, medical bills and car repairs can add up fast.

Why is Teen Driver Insurance in Colorado So Expensive Factors Influencing Premiums

Okay, let's address the elephant in the room: teen driver insurance is pricey. There's no sugarcoating it. Insurance companies base their rates on risk, and statistically, teen drivers are more likely to be involved in accidents. Here's a breakdown of the factors that contribute to those higher premiums:

- Lack of Experience: Teens simply haven't had as much time behind the wheel as more experienced drivers.

- Impulsivity: Let's be honest, teens can be impulsive. This can lead to risky driving behaviors.

- Distractions: Cell phones, friends in the car, the radio – teens face a lot of distractions while driving.

- Higher Accident Rates: Data shows that teen drivers are involved in more accidents per mile driven than older drivers.

Insurance companies consider these factors, and that's why teen drivers pay more. But don't despair! There are ways to lower those costs, which we'll get into later.

Comparing Colorado Teen Driver Insurance Providers Finding the Best Rates and Coverage

Not all insurance companies are created equal. Some specialize in insuring young drivers, while others may offer better discounts or coverage options. It pays to shop around and compare quotes from multiple providers. Here are a few companies to consider in Colorado:

- State Farm: Known for good customer service and a range of discounts.

- GEICO: Often offers competitive rates, especially for students.

- Progressive: Has a user-friendly website and offers various coverage options.

- Allstate: Provides a wide range of insurance products and may offer bundling discounts.

Important: Don't just focus on the price. Consider the coverage options, the deductible, and the company's reputation for handling claims. A slightly higher premium might be worth it for better protection and peace of mind.

Colorado Teen Driver Insurance Discounts Saving Money on Your Policy

Now for the good news: there are several ways to lower your teen driver insurance costs in Colorado. Here are some common discounts to look for:

- Good Student Discount: Maintaining good grades (usually a B average or higher) can earn you a significant discount.

- Driver's Education Discount: Completing a driver's education course demonstrates responsibility and can lower your rates.

- Safe Driver Discount: Avoiding accidents and traffic violations will keep your rates down.

- Multi-Policy Discount: Bundling your auto insurance with other policies (like homeowners or renters insurance) can save you money.

- Vehicle Safety Discount: Driving a car with safety features like anti-lock brakes and airbags can also lower your premiums.

- Away at School Discount: If your teen is away at school without a car, you might be eligible for a discount.

Pro Tip: Ask your insurance agent about all available discounts. They can help you identify which ones you qualify for.

Specific Teen Driver Insurance Product Recommendations and Comparisons in Colorado

Okay, let's get into some specific product recommendations. Remember, the best option for you will depend on your individual circumstances and budget. I'll provide a few scenarios and some potential solutions.

Scenario 1: The Budget-Conscious Family

The Goal: To find the most affordable coverage possible while still meeting Colorado's minimum requirements.

Potential Product: A basic liability policy with the minimum coverage limits. Consider GEICO or Progressive for potentially lower rates. Focus on maximizing discounts, especially the good student discount.

Usage Scenario: This is suitable for a family with an older, less valuable car that the teen will be driving. The focus is on fulfilling legal requirements and protecting against major liability claims.

Comparison: Compared to comprehensive coverage, this option saves money on premiums but offers less protection for the vehicle itself.

Estimated Price: (Insert Estimated Price Here - Research and provide a range based on average rates for minimum coverage in Colorado).

Scenario 2: The Safety-Focused Family

The Goal: To provide the most comprehensive coverage possible to protect the teen driver and the family's assets.

Potential Product: A comprehensive policy with higher liability limits, collision coverage, and uninsured/underinsured motorist coverage. Consider State Farm or Allstate for potentially more robust coverage options and customer service.

Usage Scenario: This is ideal for families with newer cars or those who want maximum protection in case of an accident, regardless of fault.

Comparison: This option offers superior protection compared to basic liability but comes at a higher premium cost.

Estimated Price: (Insert Estimated Price Here - Research and provide a range based on average rates for comprehensive coverage in Colorado).

Scenario 3: The Shared Vehicle Situation

The Goal: To ensure adequate coverage when the teen driver shares a vehicle with other family members.

Potential Product: Adding the teen driver to the parent's existing policy with increased liability limits. Consider a usage-based insurance program if available (e.g., Progressive's Snapshot or State Farm's Drive Safe & Save) to potentially lower rates based on driving habits.

Usage Scenario: This is common when a teen shares a family car. The parent's policy provides the primary coverage, and adding the teen as a driver ensures they are also protected.

Comparison: This option is often more affordable than a separate policy for the teen but requires careful consideration of coverage limits to ensure adequate protection for all drivers.

Estimated Price: (Insert Estimated Price Here - Research and provide an estimated increase to the parent's existing policy based on adding a teen driver).

Remember to get quotes from multiple companies and compare the coverage options and prices carefully.

Colorado Teen Driver Insurance Policy Options and Their Features

Here's a breakdown of common coverage options you'll encounter when shopping for teen driver insurance in Colorado:

- Liability Coverage: Covers damages you cause to others in an accident. This is required by Colorado law.

- Collision Coverage: Covers damage to your vehicle caused by a collision, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or weather damage.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages.

- Medical Payments Coverage: Covers medical expenses for you and your passengers after an accident, regardless of fault.

Consider your needs and budget when choosing coverage options. A higher deductible will lower your premium, but you'll pay more out-of-pocket if you have an accident.

Tips for Parents How to Talk to Your Teen About Safe Driving in Colorado

Insurance is important, but it's not a substitute for safe driving. As a parent, you play a crucial role in helping your teen become a responsible driver. Here are some tips for talking to your teen about safe driving:

- Lead by Example: Practice safe driving habits yourself. Your teen is watching you!

- Set Clear Expectations: Establish rules about cell phone use, passengers, and driving under the influence.

- Practice, Practice, Practice: Supervise your teen's driving and provide plenty of opportunities to practice in different conditions.

- Discuss the Risks: Talk about the dangers of distracted driving, speeding, and driving under the influence.

- Use Technology: Consider using apps or devices that monitor your teen's driving habits and provide feedback.

Open communication and consistent reinforcement are key to helping your teen become a safe and responsible driver.

Colorado Graduated Driver Licensing (GDL) Program How it Impacts Insurance

Colorado has a Graduated Driver Licensing (GDL) program designed to help new drivers gain experience gradually. The GDL program has three stages:

- Instruction Permit: Allows teens to drive with a licensed adult.

- Provisional Driver's License: Allows teens to drive unsupervised with certain restrictions (e.g., passenger limits, nighttime driving restrictions).

- Full Driver's License: Granted after meeting certain requirements and age restrictions.

Completing the GDL program can demonstrate responsibility and may qualify you for insurance discounts.

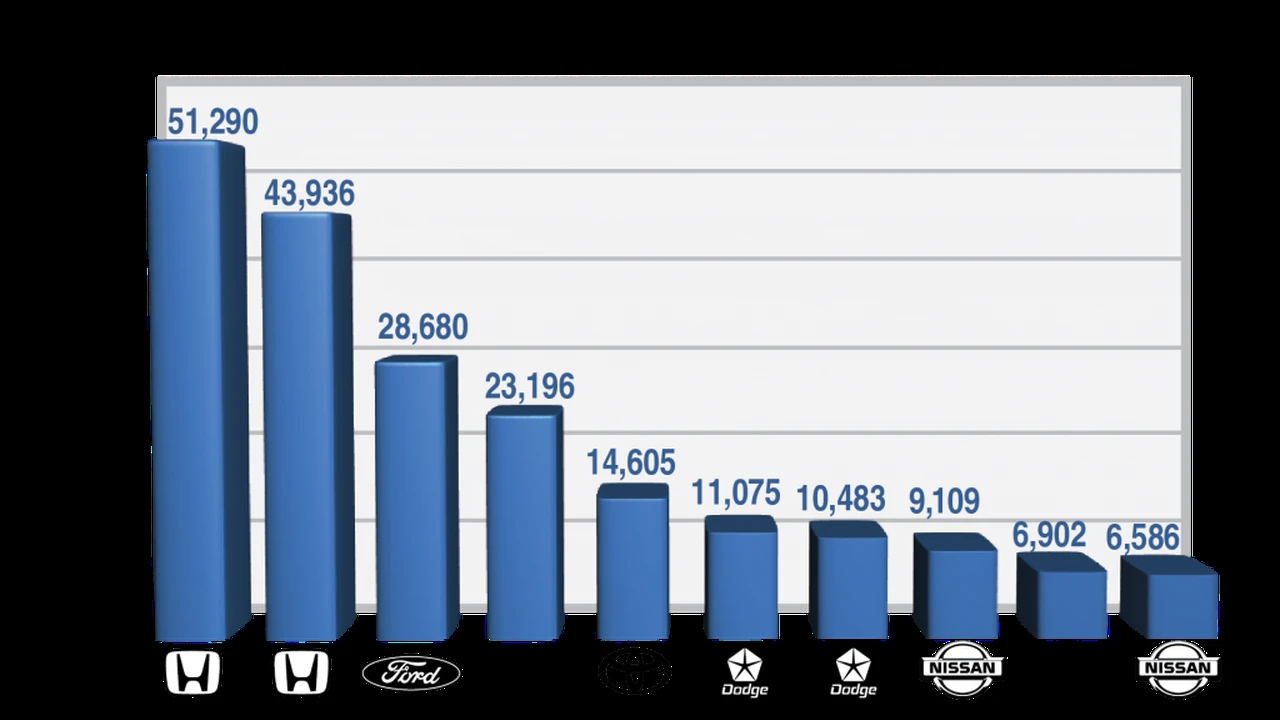

Teen Driver Accident Statistics in Colorado Understanding the Risks

It's important to be aware of the accident statistics involving teen drivers in Colorado. These statistics highlight the risks and underscore the importance of safe driving practices.

(Insert relevant statistics from Colorado Department of Transportation or other reliable sources).

Knowing the risks can help you make informed decisions about your driving habits and insurance coverage.

Future Trends in Teen Driver Insurance in Colorado Telematics and Usage-Based Pricing

The world of insurance is constantly evolving, and teen driver insurance is no exception. One emerging trend is the use of telematics and usage-based pricing.

Telematics involves using devices or apps to track driving behavior, such as speed, acceleration, braking, and mileage. This data is then used to calculate insurance premiums.

Usage-based pricing rewards safe driving habits with lower rates. This can be a great way for responsible teen drivers to save money on their insurance.

Keep an eye out for these trends as they become more prevalent in the insurance market.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)