Teen Driver Insurance and Distracted Driving

Understanding the Alarming Statistics of Teen Driver Accidents and Distracted Driving

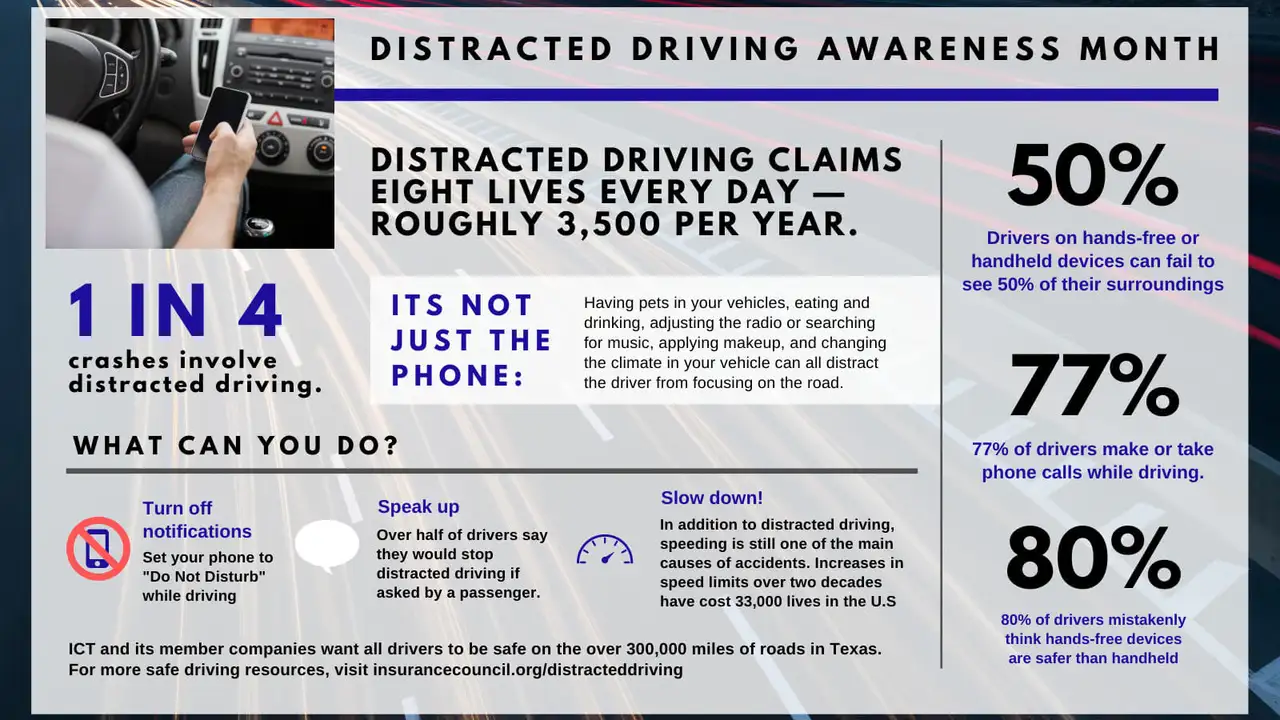

Alright, let's talk about something super important: teen drivers and distracted driving. I know, I know, it sounds like a lecture, but trust me, this is stuff you *need* to know. We're not just talking about safety; we're talking about protecting yourself, your friends, and your wallet! The stats are honestly scary. Teen drivers are way more likely to get into accidents than older, more experienced drivers, and a huge reason is… you guessed it… distractions.

Think about it: texting, changing the music, eating, talking to friends in the back seat – all these things take your eyes off the road, even for a second. And that's all it takes for something bad to happen. The National Highway Traffic Safety Administration (NHTSA) says that distracted driving is a major factor in teen crashes. We're talking thousands of accidents every year. Don't be a statistic! Seriously, put that phone down.

The Different Types of Distractions Impacting Teen Driving Safety

Distractions aren’t just about phones, though that's a big one. There are actually a bunch of different types, and being aware of them is half the battle. Let's break it down:

- Visual Distractions: Anything that takes your eyes off the road. This is the obvious one – texting, looking at GPS, checking out something interesting on the side of the road (rubbernecking!).

- Manual Distractions: Anything that takes your hands off the wheel. Eating, drinking, adjusting the radio, reaching for something in the back seat.

- Cognitive Distractions: Anything that takes your mind off driving. Daydreaming, arguing with a passenger, being stressed or upset.

See? It's not just phones. Even thinking about something else can be dangerous. The goal is to be 100% focused on driving when you're behind the wheel. Easier said than done, I know, but practice makes perfect.

How Distracted Driving Affects Teen Driver Insurance Rates

Okay, so now we get to the part that *really* hits home: your insurance. Accidents caused by distracted driving can seriously jack up your rates. Insurance companies see you as a high-risk driver if you have a history of accidents or even traffic tickets for things like texting while driving. And high-risk drivers pay more. A *lot* more.

Think about it: insurance companies are basically betting that you *won't* get into an accident. If you have a history of being a distracted driver, they're betting against you, and they're going to charge you accordingly. So, avoiding distractions isn't just about safety; it's about keeping your insurance premiums down. And trust me, as a teen driver, you need all the help you can get in that department!

Top Teen Driver Insurance Companies and Their Distraction-Focused Policies

So, which insurance companies are the best for teen drivers, especially when it comes to addressing distracted driving? Here are a few that are worth checking out:

- State Farm: They offer a "Steer Clear" program that uses a mobile app to track driving habits and reward safe behavior. It can actually lower your premiums!

- Allstate: Allstate has a "Drivewise" program that also uses a mobile app to monitor driving habits. It gives you feedback on things like hard braking, speeding, and phone use while driving.

- Progressive: Progressive's "Snapshot" program is similar to State Farm and Allstate's, but it also offers personalized driving tips to help you improve your skills.

- USAA: If you or a family member is in the military, USAA is a great option. They're known for their competitive rates and excellent customer service.

Comparing Insurance Products: State Farm Steer Clear vs Allstate Drivewise

Let's dive a little deeper into two of the most popular programs: State Farm Steer Clear and Allstate Drivewise.

State Farm Steer Clear: This program is designed specifically for young drivers. It uses a mobile app to track things like speeding, hard braking, and phone use. You earn points for safe driving, and those points can translate into discounts on your insurance premiums. It's a great way to prove to your insurance company that you're a responsible driver.

Allstate Drivewise: Drivewise is similar to Steer Clear, but it offers a little more flexibility. You can choose to have your driving monitored through a mobile app or a device that plugs into your car. Drivewise also provides more detailed feedback on your driving habits, so you can see exactly where you need to improve.

Which one is better? It really depends on your individual needs and preferences. Steer Clear is great if you're specifically looking for a program designed for young drivers. Drivewise offers more flexibility and detailed feedback. It's worth checking out both programs to see which one is the best fit for you.

Real-World Usage Scenarios and the Cost of Distracted Driving Insurance

Let's imagine a couple of scenarios:

- Scenario 1: Sarah is a 17-year-old driver who just got her license. She's excited to drive her friends around, but she also knows that distracted driving is a big problem. She signs up for State Farm's Steer Clear program and uses the app to track her driving habits. She's careful to avoid distractions, and she earns a discount on her insurance premiums.

- Scenario 2: Michael is an 18-year-old driver who's always on his phone. He texts while driving, changes the music constantly, and often drives with his friends in the car. He gets into a fender bender because he wasn't paying attention. His insurance rates skyrocket, and he has to pay a hefty deductible.

These scenarios illustrate the real-world impact of distracted driving on insurance rates. The cost of distracted driving insurance can vary depending on a number of factors, including your age, driving history, and the type of car you drive. However, you can generally expect to pay significantly more if you have a history of accidents or traffic tickets for distracted driving.

Here's a rough idea of the cost:

- Clean driving record: $150 - $300 per month (for a teen driver)

- One accident caused by distracted driving: $250 - $500 per month (or even higher)

See? It adds up quickly. Avoiding distractions is the best way to save money on your insurance.

Specific Products and Their Pricing: Mobile Phone Mounts, Bluetooth Headsets, and Driving Apps

Okay, so you're convinced that distracted driving is bad. Now what? Here are some specific products that can help you stay focused behind the wheel:

- Mobile Phone Mounts: These are essential for keeping your phone out of your hands and in your line of sight. You can find them for as little as $10-$20 on Amazon. Look for ones that attach securely to your dashboard or windshield.

- Bluetooth Headsets: If you need to take a call while driving, a Bluetooth headset is a must-have. They allow you to keep both hands on the wheel and your eyes on the road. Prices range from $20-$100, depending on the features and quality.

- Driving Apps: There are a ton of apps that can help you stay focused while driving. Some block incoming calls and texts, while others reward you for safe driving habits. Many are free, while others have a subscription fee.

Here are a few specific recommendations:

- Phone Mount: iOttie Easy One Touch 5 (around $25) - Super easy to use and very secure.

- Bluetooth Headset: Jabra Talk 45 (around $80) - Great sound quality and long battery life.

- Driving App: Life360 (Free with premium options) - Tracks driving behavior and provides insights into risky habits. Can also be used for family safety.

Tips and Tricks to Avoid Distracted Driving and Lower Your Insurance Premiums

Alright, let's wrap this up with some practical tips and tricks to help you avoid distractions and save money on your insurance:

- Put your phone away! Seriously, put it in the glove compartment or the back seat. Out of sight, out of mind.

- Use a driving app to block distractions. There are plenty of apps that can automatically block incoming calls and texts when you're driving.

- Plan your route ahead of time. Use a GPS app to plan your route before you start driving, so you don't have to mess with it while you're on the road.

- Adjust your mirrors and radio before you start driving. Get everything set up before you put the car in drive.

- Avoid eating or drinking while driving. It's just not worth the risk.

- Pull over if you need to make a call or send a text. It's better to be safe than sorry.

- Tell your passengers to be quiet and avoid distracting you. Your passengers should be helping you stay focused, not distracting you.

- Get enough sleep. Drowsy driving is just as dangerous as distracted driving.

- Take breaks on long trips. Stop every few hours to stretch your legs and clear your head.

- Sign up for a safe driving program offered by your insurance company. These programs can help you improve your driving habits and earn discounts on your insurance premiums.

Driving is a privilege, not a right. Be responsible, stay focused, and arrive alive! And remember, avoiding distractions isn't just about keeping yourself safe; it's about protecting everyone else on the road too.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)