Teen Driver Insurance in Massachusetts: Understanding Premiums

Understanding the High Cost of Teen Driver Insurance in Massachusetts

Alright, let's talk about something nobody likes: insurance. Especially teen driver insurance in Massachusetts. If you're a parent, you're probably already cringing. Why? Because insuring a teenage driver in the Bay State is, to put it mildly, expensive. We're not talking pocket change here; we're talking potentially thousands of dollars per year. But why is it so pricey? Well, buckle up, because we're about to dive deep into the factors that drive up those premiums.

First and foremost, it's all about risk. Teenagers, statistically speaking, are more likely to get into accidents than older, more experienced drivers. They're more prone to speeding, distracted driving (hello, smartphones!), and simply making poor decisions behind the wheel. Insurance companies aren't being mean; they're just crunching the numbers. Higher risk equals higher premiums. It's a cold, hard fact.

Massachusetts, in particular, has some unique characteristics that contribute to the high cost. The state has a high population density, which means more cars on the road and a greater chance of accidents. Plus, the winters can be brutal, leading to hazardous driving conditions. The state's no-fault insurance laws also play a role, as they can increase the overall cost of claims. So, yeah, it's a perfect storm of factors that make teen driver insurance in Massachusetts a budget buster.

Key Factors Influencing Teen Driver Insurance Premiums in Massachusetts

Okay, so we know it's expensive. But what specific things are insurance companies looking at when they set your rates? Here's a breakdown of the key factors:

- Driver's Age and Experience: This is a big one. The younger and less experienced the driver, the higher the premium. A 16-year-old with a learner's permit will pay significantly more than an 18-year-old with a year or two of driving under their belt.

- Driving Record: Any accidents or traffic violations on the teen's record will send premiums soaring. Even a minor speeding ticket can have a significant impact.

- Type of Vehicle: The car your teen drives matters. A sporty, high-performance vehicle will be more expensive to insure than a safe, family sedan. Insurance companies consider the likelihood of accidents and the cost of repairs.

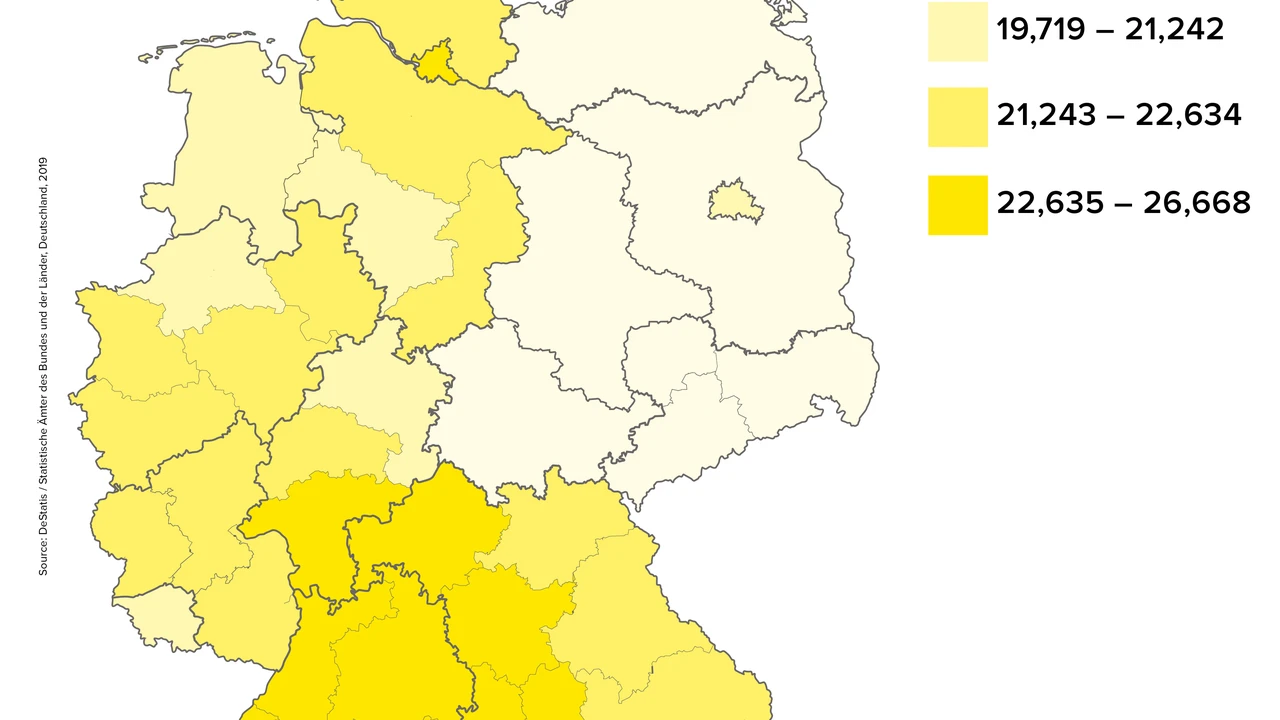

- Location: Where you live in Massachusetts can affect your rates. Urban areas with higher traffic density and crime rates tend to have higher premiums than rural areas.

- Coverage Levels: The amount of coverage you choose also impacts the price. Higher liability limits, collision coverage, and comprehensive coverage will all increase your premium.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible will result in a lower premium, but you'll have to pay more if you have an accident.

- Insurance Company: Different insurance companies have different pricing models. It's important to shop around and compare quotes from multiple insurers to find the best deal.

Strategies for Reducing Teen Driver Insurance Costs in Massachusetts

Alright, enough doom and gloom. Let's talk about what you can actually do to lower those sky-high premiums. Here are some proven strategies:

- Good Student Discount: Many insurance companies offer discounts to students who maintain good grades (usually a B average or higher). This is a great incentive for your teen to hit the books!

- Driver's Education Discount: Completing a driver's education course can also qualify your teen for a discount. These courses teach safe driving techniques and help reduce the risk of accidents.

- Defensive Driving Course: Taking a defensive driving course can further reduce premiums, especially if your teen has a clean driving record.

- Increase the Deductible: Raising your deductible can lower your premium, but make sure you can afford to pay the higher deductible if you have an accident.

- Choose a Safe Vehicle: Opt for a vehicle with good safety ratings and features like anti-lock brakes, airbags, and electronic stability control.

- Add Your Teen to Your Existing Policy: In most cases, it's cheaper to add your teen to your existing auto insurance policy than to purchase a separate policy.

- Shop Around: As mentioned earlier, it's crucial to compare quotes from multiple insurance companies. Don't just settle for the first quote you get.

- Monitor Driving Habits: Some insurance companies offer programs that monitor your teen's driving habits using a telematics device. If your teen demonstrates safe driving behavior, you could earn a discount.

Specific Teen Driver Insurance Products and Comparisons in Massachusetts

Now let's get down to brass tacks and look at some specific insurance products and companies operating in Massachusetts that cater to teen drivers. Remember, prices can vary significantly based on individual circumstances, so always get a personalized quote.

Product 1: State Farm Drive Safe & Save

Description: State Farm's Drive Safe & Save program uses a mobile app or a small device plugged into your car to track driving habits. It monitors things like speeding, hard braking, and mileage. Safe drivers are rewarded with significant discounts.

Usage Scenario: Ideal for conscientious teens who are willing to demonstrate their safe driving skills. Parents can also use the app to monitor their teen's driving and provide feedback.

Comparison: Compared to other usage-based insurance programs, State Farm's Drive Safe & Save is known for its ease of use and its potential for substantial discounts. However, aggressive driving can lead to higher premiums.

Price: Discounts can range from 5% to 50% depending on driving behavior. A typical policy for a teen driver with State Farm, *before* the discount, might be around $3,000 per year. The actual price depends on the factors listed above.

Product 2: Liberty Mutual RightTrack

Description: Similar to State Farm's program, Liberty Mutual's RightTrack uses a telematics device or a mobile app to track driving behavior. You get an initial discount just for signing up, and then your rate is adjusted based on your driving habits.

Usage Scenario: Good for teens who drive regularly and are confident in their ability to drive safely. The initial discount is a nice perk, even if you don't qualify for the maximum discount.

Comparison: RightTrack differs from State Farm's program in that it offers an initial discount regardless of driving behavior. However, the potential for ongoing discounts may be lower than with State Farm.

Price: The initial discount is typically around 5-10%. The overall policy cost, *before* any discounts, for a teen driver with Liberty Mutual could be in the $2,800 - $3,500 range annually.

Product 3: Geico DriveEasy

Description: Geico's DriveEasy is a mobile app-based program that monitors driving habits like hard braking, speeding, phone usage, and nighttime driving. Good driving habits lead to lower premiums.

Usage Scenario: Perfect for teens who are already glued to their phones (but hopefully not while driving!). The app provides feedback on driving behavior, helping teens become safer drivers.

Comparison: Geico DriveEasy is known for its user-friendly app and its focus on distracted driving. It's a good option for teens who are prone to using their phones while driving.

Price: Discounts vary depending on driving behavior, but can be significant. A Geico policy for a teen driver in Massachusetts, *without* the DriveEasy discount, might cost around $2,500 - $3,200 per year.

Product 4: Progressive Snapshot

Description: Progressive Snapshot uses a plug-in device to monitor driving habits. It focuses on when you drive, how you drive (hard braking and rapid acceleration), and how much you drive.

Usage Scenario: A good choice for teens who don't drive excessively and who avoid driving during peak hours or late at night. The device is easy to install and use.

Comparison: Progressive Snapshot is one of the original usage-based insurance programs and has a proven track record. It's a good option for teens who want a simple and straightforward way to save money on their insurance.

Price: Discounts vary depending on driving behavior. A Progressive policy for a teen driver, *prior* to the Snapshot discount, might be in the ballpark of $2,700 - $3,400 annually.

Navigating Massachusetts Teen Driver Insurance: Tips and Tricks

Okay, so you've got some options. But navigating the world of teen driver insurance in Massachusetts can still be confusing. Here are a few extra tips and tricks to keep in mind:

- Start Early: Begin researching insurance options well before your teen gets their learner's permit. This will give you time to compare quotes and understand the different coverage options.

- Talk to Your Insurance Agent: Your insurance agent can provide personalized advice and help you find the best coverage for your needs and budget.

- Read the Fine Print: Make sure you understand the terms and conditions of your policy, including the deductible, coverage limits, and exclusions.

- Consider Umbrella Insurance: If you have significant assets, you might want to consider purchasing umbrella insurance to provide extra liability coverage.

- Stay Informed: Insurance laws and regulations can change, so stay up-to-date on the latest developments.

Insuring a teen driver in Massachusetts is undoubtedly expensive, but it's also essential. By understanding the factors that influence premiums and taking advantage of available discounts, you can make it a little more affordable. Remember to shop around, compare quotes, and choose the coverage that best meets your needs and budget. Good luck!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)