Teen Driver Insurance in Missouri: What You Need to Know

Understanding Teen Driver Insurance Missouri Basics and Requirements

Okay, so you've got a teen in Missouri who's just gotten their license. Congrats! Freedom! But also...insurance. Ugh. Let's break down the basics of teen driver insurance in Missouri. First things first, Missouri law requires all drivers to carry auto insurance. That includes your newly licensed teen. The minimum liability coverage requirements are: $25,000 for bodily injury or death of one person in an accident, $50,000 for bodily injury or death of more than one person in an accident, and $25,000 for property damage. While these are the minimums, seriously consider getting higher limits. Trust me, you don't want to be on the hook for more than that if your teen causes an accident.

Why is teen driver insurance so expensive? Well, statistically, teens are more likely to be involved in accidents. They're inexperienced, easily distracted (hello, smartphones!), and sometimes a little overconfident behind the wheel. Insurance companies see them as a higher risk, hence the higher premiums. Factors that influence the cost include the teen's driving record (or lack thereof), the type of car they drive, your location (urban areas tend to be pricier), and your chosen coverage levels.

Finding the Cheapest Teen Driver Insurance in Missouri Comparing Quotes and Discounts

Alright, let's talk about saving some money. Finding the cheapest teen driver insurance in Missouri isn't always about going with the absolute lowest quote. It's about finding the best value for your money. Shop around! Get quotes from multiple insurance companies. Don't just stick with the company you've always used. Online comparison tools can be helpful, but also talk to independent insurance agents. They can often find deals you wouldn't find on your own.

Discounts are your friend! Ask about good student discounts (if your teen maintains a B average or better), driver's education discounts (completing a state-approved driver's ed course), multi-car discounts (insuring multiple vehicles with the same company), and safe driver discounts (if your teen maintains a clean driving record – easier said than done, I know!). Some companies even offer discounts for having anti-theft devices installed in the car or for being a member of certain organizations.

Another tip: Consider increasing your deductible. A higher deductible means you'll pay more out-of-pocket if you have an accident, but it will also lower your monthly premiums. Just make sure you can afford to pay that deductible if something happens.

Specific Teen Driver Insurance Products in Missouri and Their Features

Let's dive into some specific insurance products and scenarios. We're not endorsing any specific company here, just giving you examples of what to look for.

Scenario 1: The Brand New Driver with a Used Car. Let's say your teen is driving an older, reliable sedan that you already own. You'll likely want to add them to your existing policy. Companies like State Farm, GEICO, and Progressive all offer coverage options for teen drivers. In this case, you might focus on liability coverage, collision coverage (to cover damage to your car in an accident, regardless of fault), and comprehensive coverage (to cover damage from things like theft, vandalism, or weather). Consider a higher deductible to keep premiums down.

Scenario 2: The Teen with a Shiny New Car. Okay, maybe you're feeling generous and got your teen a brand new car (or they worked hard and bought it themselves!). In this case, you'll definitely want full coverage, including collision and comprehensive. You might also consider gap insurance, which covers the difference between what you owe on the car and what it's worth if it's totaled. Allstate and Farmers are good options to explore for comprehensive coverage packages.

Product Comparison: Usage-Based Insurance. Some companies, like Progressive with Snapshot, and State Farm with Drive Safe & Save, offer usage-based insurance programs. These programs track your teen's driving habits (speed, hard braking, time of day) using a mobile app or a device plugged into the car. If your teen drives safely, you could get a significant discount. However, if they're prone to speeding or hard braking, your rates could actually go up. It's a gamble, but it can be a good option for responsible teens. The price varies significantly, but discounts can range from 5% to 30% or more.

Product Example: GEICO DriveEasy. GEICO's DriveEasy is another usage-based insurance program. It uses a mobile app to track driving behavior and provide personalized feedback. Drivers earn points for safe driving habits, which translate into discounts on their premiums. The app monitors things like speeding, hard braking, distracted driving (phone usage while driving), and time of day. It's a good way for teens to become more aware of their driving habits and potentially save money in the process. Discounts can vary, but many users report saving between 10% and 20% on their premiums. The initial cost is the same as a regular GEICO policy, but the potential for savings makes it an attractive option.

Product Example: Allstate Drivewise. Similar to GEICO DriveEasy, Allstate Drivewise tracks driving behavior through a mobile app. It monitors speed, hard braking, and the time of day when driving occurs. Drivewise provides feedback to drivers, helping them understand their driving habits and identify areas for improvement. Unlike some other programs, Drivewise doesn't penalize drivers for poor driving habits; it only rewards safe driving. This makes it a less risky option for parents who are concerned about their teen's driving skills. The savings potential varies, but Allstate claims that drivers can save up to 40% on their premiums. There's no upfront cost to enroll in Drivewise; it's simply added to your existing Allstate policy.

Comparing Teen Driver Insurance Rates Missouri Factors and Considerations

Okay, so how do you actually compare those quotes you've gathered? Don't just look at the bottom line. Look at the coverage levels. Are you comparing apples to apples? One policy might be cheaper, but it might also have lower liability limits or a higher deductible. Consider the reputation of the insurance company. Read online reviews. How are their customer service and claims handling? You don't want to be dealing with a nightmare company after an accident.

Also, consider the type of car your teen is driving. A sporty car will be more expensive to insure than a family sedan. Safety features can also impact rates. Cars with anti-lock brakes, airbags, and electronic stability control often qualify for discounts.

Your location matters too. If you live in a densely populated area with high traffic, your rates will likely be higher than if you live in a rural area. Areas with high rates of car theft or vandalism will also have higher insurance costs.

Finally, remember that insurance rates are constantly changing. It's a good idea to shop around for insurance every year, even if you're happy with your current company. You might be surprised at how much you can save.

Strategies for Reducing Teen Driver Insurance Costs in Missouri Driver Safety Programs

Beyond discounts and shopping around, there are other things you can do to reduce teen driver insurance costs in Missouri. Consider enrolling your teen in a defensive driving course. These courses teach teens how to anticipate and avoid accidents. Many insurance companies offer discounts for completing these courses. Set clear rules for your teen driver. No texting while driving! No friends in the car for the first few months! No driving after midnight! Enforce these rules consistently.

Lead by example. Your teen is watching you! If you drive safely and follow the rules of the road, they're more likely to do the same. Have open and honest conversations about the dangers of distracted driving and drunk driving. Make sure your teen understands the consequences of their actions.

Consider adding a telematics device to your teen's car. These devices track driving behavior and provide feedback. Some insurance companies offer discounts for using telematics devices, and they can also help you monitor your teen's driving habits.

Finally, remember that patience is key. As your teen gains experience behind the wheel and maintains a clean driving record, their insurance rates will eventually go down. It's a long game, but it's worth it.

Specific Product Recommendations and Pricing Examples

Let's get into some hypothetical pricing and product scenarios. Remember, these are examples, and actual rates will vary based on individual circumstances.

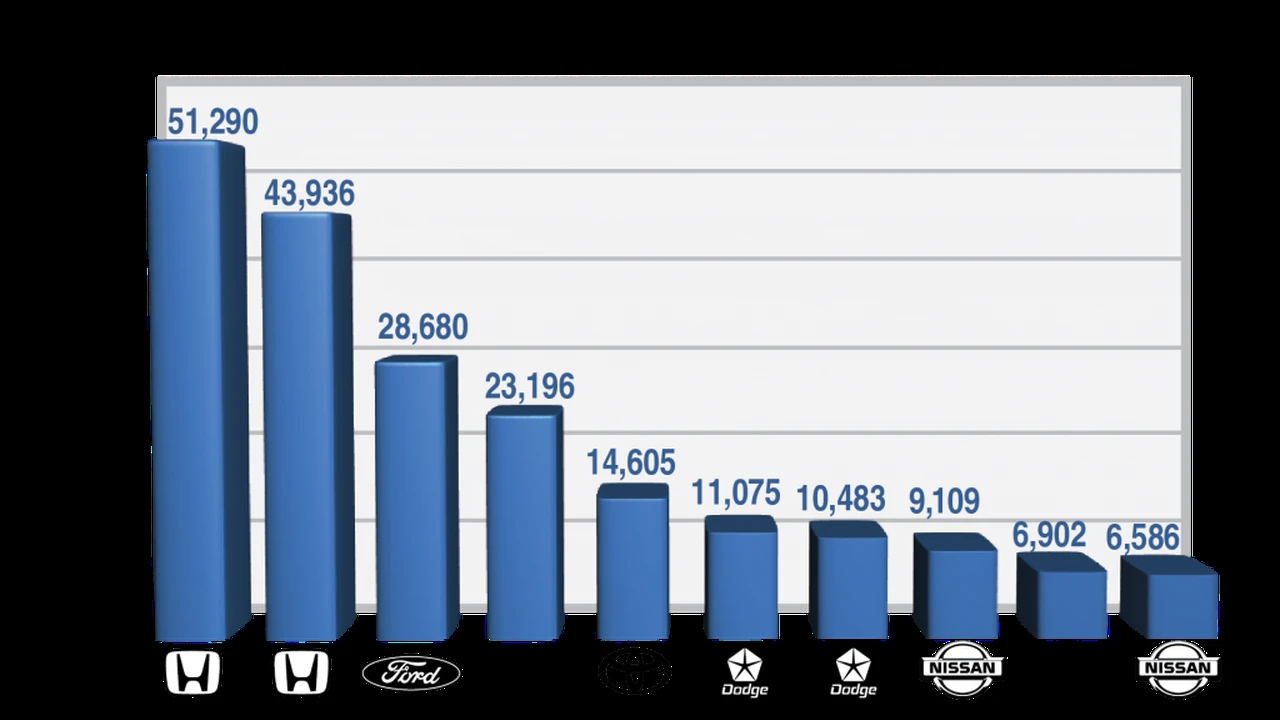

Example 1: Adding a 16-year-old male driver to a policy with a 2015 Honda Civic. With minimum liability coverage, you might expect to pay an additional $150-$250 per month with GEICO, State Farm, or Progressive. With full coverage (including collision and comprehensive), that could jump to $300-$500 per month. Adding a usage-based insurance program like Snapshot or Drive Safe & Save could potentially lower that rate by 10-20% if the teen drives safely.

Example 2: A 17-year-old female driver with a clean driving record and a good student discount driving a 2018 Toyota Camry. With full coverage, you might find rates in the $250-$400 per month range with companies like Allstate or Farmers. A good student discount could shave off 5-10% of that cost. Enrolling in a defensive driving course could also result in a discount.

Product Recommendation: Liberty Mutual RightTrack. Liberty Mutual's RightTrack is another usage-based insurance program that offers personalized rates based on driving behavior. The program uses a mobile app or a plug-in device to track driving habits, such as hard braking, speeding, and nighttime driving. Drivers who demonstrate safe driving habits can earn discounts of up to 30% on their premiums. RightTrack is a good option for parents who want to encourage safe driving and potentially save money on their teen's insurance. The cost is the same as a standard Liberty Mutual policy, with the potential for significant savings based on driving performance.

Product Recommendation: USAA SafePilot. USAA SafePilot is a usage-based insurance program available to USAA members. It monitors driving behavior through a mobile app and provides feedback to drivers. SafePilot rewards safe driving habits with discounts on premiums. The app tracks things like hard braking, speeding, and phone usage while driving. Unlike some other programs, SafePilot doesn't penalize drivers for poor driving habits; it only rewards safe driving. This makes it a less risky option for parents who are concerned about their teen's driving skills. The savings potential varies, but USAA claims that drivers can save up to 30% on their premiums. To be eligible for SafePilot, you must be a USAA member, which typically requires a connection to the military.

Disclaimer: These are just estimates. The best way to find out how much teen driver insurance will cost in Missouri is to get quotes from multiple insurance companies. Be sure to compare coverage levels and deductibles to find the best value for your money.

Navigating the Complexities of Missouri Teen Driver Insurance

Look, teen driver insurance is complicated. It's expensive. It's frustrating. But it's also essential. By understanding the basics, shopping around for the best rates, and encouraging safe driving habits, you can hopefully navigate this process without completely breaking the bank. Good luck!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)