Teen Driver Insurance in Indiana: Coverage Basics

Understanding Indiana Teen Driver Insurance Requirements

Alright, let's talk teen driver insurance in Indiana. It's a topic that can make any parent's head spin, but understanding the basics is crucial. Indiana, like most states, has minimum liability insurance requirements. This is the legal floor you need to meet to drive legally. Typically, this includes coverage for:

- Bodily Injury Liability: This covers the costs if your teen driver injures someone else in an accident. Indiana requires a minimum of $25,000 per person and $50,000 per accident.

- Property Damage Liability: This covers damage your teen driver causes to someone else's property, like their car or a fence. Indiana requires a minimum of $25,000.

While these are the minimums, seriously consider getting higher coverage limits. Why? Because if your teen causes a serious accident and the damages exceed your insurance limits, you could be personally liable for the remaining costs. Think medical bills, car repairs, lawsuits... it adds up fast.

Adding Your Teen to Your Existing Indiana Auto Insurance Policy: The Easiest Route

The most common way to insure your teen driver in Indiana is to add them to your existing auto insurance policy. This is usually the most straightforward and often the most cost-effective option. When you add a teen driver, your insurance company will reassess your risk and adjust your premiums accordingly. Expect an increase, but don't panic! There are ways to mitigate the cost, which we'll get into later.

Before you add your teen, be prepared to provide the insurance company with some information, including:

- Your teen's driver's license number

- The make and model of the car they will be driving (or primarily driving)

- Information about their driving record (if any)

Stand-Alone Indiana Teen Driver Insurance Policies: A More Expensive Option

While less common, you can also purchase a stand-alone auto insurance policy specifically for your teen driver. This means your teen has their own policy, separate from your own. This might seem appealing if you're worried about your teen's driving affecting your own insurance rates, but it's usually significantly more expensive. Think of it as paying for the privilege of keeping your own rates untouched, but at a hefty price.

When might a stand-alone policy make sense? Perhaps if your teen has a particularly risky driving record (lots of tickets or accidents), or if you want to completely shield your own policy from any potential claims. However, weigh the costs carefully. The premium difference can be substantial.

Indiana Teen Driver Insurance Coverage Options: Beyond the Basics

Beyond the legally required liability coverage, there are several other types of insurance coverage you should consider for your teen driver in Indiana:

- Collision Coverage: This covers damage to your car if your teen driver causes an accident, regardless of who's at fault. So, even if they rear-end someone, collision coverage will help pay for the repairs to your vehicle (minus your deductible, of course). This is especially important if you have a newer or more valuable car.

- Comprehensive Coverage: This covers damage to your car from things other than collisions, like theft, vandalism, fire, hail, or hitting a deer (a common occurrence in Indiana!). This is a good idea regardless of who's driving, but especially important for teen drivers who might be less experienced at avoiding hazards.

- Uninsured/Underinsured Motorist Coverage: This protects you if your teen driver is hit by someone who doesn't have insurance or doesn't have enough insurance to cover the damages. Unfortunately, uninsured drivers are a reality, and this coverage can be a lifesaver.

- Medical Payments Coverage (MedPay): This covers medical expenses for your teen driver and their passengers if they're injured in an accident, regardless of who's at fault. This can help cover immediate medical bills while you're sorting out the details of who's responsible.

Indiana Teen Driver Insurance Discounts: Saving Money Where You Can

Okay, now for the good news! There are several discounts available that can help lower the cost of teen driver insurance in Indiana. Here are a few to look into:

- Good Student Discount: If your teen maintains good grades (usually a B average or higher), they may qualify for a discount. Insurance companies see good grades as an indicator of responsibility.

- Driver's Education Discount: Completing a driver's education course can often earn you a discount. These courses teach safe driving habits and can make your teen a safer driver, in the eyes of the insurance company.

- Away at School Discount: If your teen is away at college without a car, you may be able to get a discount. The logic is that they're driving less, so the risk is lower.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may be eligible for a discount.

- Safe Driver Discount: Once your teen has a clean driving record for a certain period (usually 3-5 years), they may qualify for a safe driver discount.

Comparing Indiana Teen Driver Insurance Companies: Finding the Best Fit

Shopping around is crucial when it comes to finding the best teen driver insurance rates in Indiana. Don't just stick with the first quote you get! Get quotes from multiple insurance companies and compare their coverage options, deductibles, and discounts. Some popular insurance companies in Indiana include:

- State Farm: Known for their strong customer service and a wide range of coverage options.

- Allstate: Another large insurer with competitive rates and a variety of discounts.

- Progressive: Often a good choice for drivers with less-than-perfect driving records.

- GEICO: Known for their low rates, especially for safe drivers.

- Indiana Farm Bureau Insurance: A regional insurer with a strong presence in Indiana, often offering competitive rates for rural residents.

Specific Indiana Teen Driver Insurance Product Recommendations and Comparisons

Let's dive into some specific product recommendations, keeping in mind that prices can vary significantly based on your individual circumstances (your teen's driving record, the car they drive, your location, etc.). These are examples, and you should always get personalized quotes.

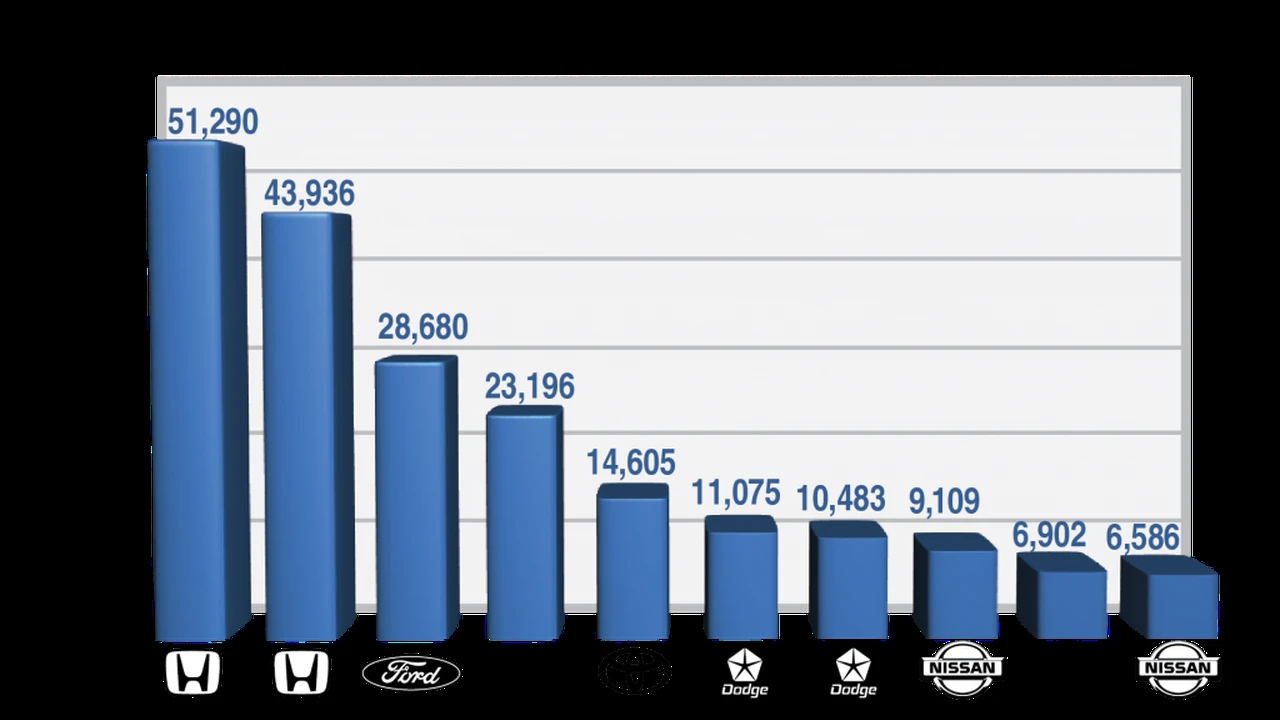

Product Comparison: State Farm vs. Progressive for a 16-Year-Old Driver in Indianapolis

Let's say you have a 16-year-old driver in Indianapolis driving a 2018 Honda Civic. Here's a hypothetical comparison:

State Farm:

- Policy: Comprehensive, Collision, Liability (100/300/100), Uninsured Motorist, MedPay

- Estimated Annual Premium: $2,800

- Key Features: Strong customer service, Drive Safe & Save (telematics program for potential discounts based on driving habits), good student discount available.

- Usage Scenario: Ideal for parents who value excellent customer service and are willing to pay a bit more for peace of mind. The Drive Safe & Save program can be a great way to encourage safe driving habits and potentially lower premiums.

Progressive:

- Policy: Comprehensive, Collision, Liability (100/300/100), Uninsured Motorist, MedPay

- Estimated Annual Premium: $2,500

- Key Features: Snapshot (telematics program), Name Your Price tool, competitive rates for drivers with less experience.

- Usage Scenario: A good choice for parents who are looking for the most affordable option and are comfortable using a telematics program. The Name Your Price tool allows you to adjust coverage options to fit your budget.

Product Recommendation: GEICO for a Budget-Conscious Family in Fort Wayne

If you're a budget-conscious family in Fort Wayne, GEICO is often a strong contender. They are known for their competitive rates, especially for safe drivers. A basic policy with liability, comprehensive, and collision coverage might cost around $2,200 annually for a 17-year-old driver with a clean record driving a 2015 Toyota Corolla.

- Policy: Comprehensive, Collision, Liability (50/100/50), Uninsured Motorist

- Estimated Annual Premium: $2,200

- Key Features: Competitive rates, mobile app for easy policy management, potential discounts for military personnel and government employees.

- Usage Scenario: Best for families who prioritize affordability and are comfortable managing their policy online or through a mobile app.

Product Recommendation: Indiana Farm Bureau Insurance for Rural Families

If you live in a rural area of Indiana, Indiana Farm Bureau Insurance is worth considering. They often offer competitive rates and understand the unique needs of rural residents. For example, they might offer better coverage for damage caused by farm equipment or livestock.

- Policy: Comprehensive, Collision, Liability (100/300/100), Uninsured Motorist, MedPay

- Estimated Annual Premium: $2,600

- Key Features: Local agents, strong community involvement, potential discounts for Farm Bureau members.

- Usage Scenario: Ideal for families who prefer to work with a local agent and support a community-focused insurance provider. Their specialized coverage options can be beneficial for rural residents.

Understanding Indiana Teen Driver Insurance Pricing Factors

Several factors influence the cost of teen driver insurance in Indiana. Understanding these factors can help you make informed decisions and potentially lower your premiums.

- Age: Younger drivers are statistically more likely to be involved in accidents, so their insurance rates are higher. As your teen gets older and gains more experience, their rates will gradually decrease.

- Driving Record: A clean driving record is essential for getting the best rates. Tickets and accidents will significantly increase your premiums.

- Type of Car: The make and model of the car your teen drives will also affect your insurance rates. Expensive cars and cars that are known for being high-performance will typically cost more to insure.

- Location: Insurance rates vary by location. Urban areas tend to have higher rates than rural areas due to higher traffic density and a greater risk of accidents.

- Coverage Limits: The higher your coverage limits, the more you'll pay for insurance. However, it's important to have adequate coverage to protect yourself financially.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible will lower your premiums, but you'll have to pay more if you have a claim.

Indiana Graduated Driver Licensing (GDL) Program and Insurance Implications

Indiana has a Graduated Driver Licensing (GDL) program designed to help new drivers gain experience gradually and safely. The GDL program has three stages:

- Learner's Permit: Requires supervised driving with a licensed driver who is at least 25 years old or a spouse who is at least 21 years old.

- Probationary Driver's License: Has restrictions on nighttime driving and passenger limits.

- Unrestricted Driver's License: Issued after meeting certain requirements and age milestones.

The GDL program can actually help lower your teen's insurance rates. The longer they drive with a learner's permit and a probationary license, the more experience they gain, and the lower their risk profile becomes in the eyes of the insurance company. Make sure your teen follows all the GDL restrictions to maintain a clean driving record.

Tips for Lowering Indiana Teen Driver Insurance Costs

Let's recap some key strategies for saving money on teen driver insurance in Indiana:

- Shop Around: Get quotes from multiple insurance companies.

- Take Advantage of Discounts: Look for good student, driver's education, and other available discounts.

- Consider a Higher Deductible: If you can afford to pay more out-of-pocket in the event of an accident, a higher deductible can lower your premiums.

- Encourage Safe Driving Habits: A clean driving record is the best way to keep your insurance rates low.

- Consider a Telematics Program: These programs track your teen's driving habits and offer potential discounts for safe driving.

- Review Your Coverage Annually: As your teen gets older and gains more experience, you may be able to lower your coverage limits or adjust your deductible.

Insuring a teen driver in Indiana can be expensive, but by understanding the basics, shopping around, and taking advantage of available discounts, you can find affordable coverage that protects your family and your finances. Remember to prioritize safety and encourage responsible driving habits. Good luck!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)