Teen Driver Insurance and Good Student Discounts

Understanding Teen Driver Insurance Costs What Factors Influence Premiums

So, you're diving into the world of teen driver insurance, huh? Buckle up! It's a wild ride, but understanding the basics can save you a ton of money and headaches. Let's break down what makes teen driver insurance so pricey.

First off, let's talk about risk. Insurance companies are all about assessing risk, and statistically, teen drivers are considered higher risk. They're less experienced, more prone to distractions, and, let's be honest, sometimes make questionable decisions behind the wheel. This higher risk translates directly into higher premiums.

Several factors influence those premiums. Here are some key ones:

- Age: Younger teens (16-17) typically face the highest rates. As they gain experience and reach 18 or 19, rates tend to decrease.

- Driving Record: Any accidents, tickets, or violations on a teen's driving record will significantly increase insurance costs. A clean record is crucial.

- Type of Vehicle: Driving a sporty, high-performance car will cost more to insure than driving a safe, family sedan. Insurance companies consider the likelihood of accidents and the cost of repairs.

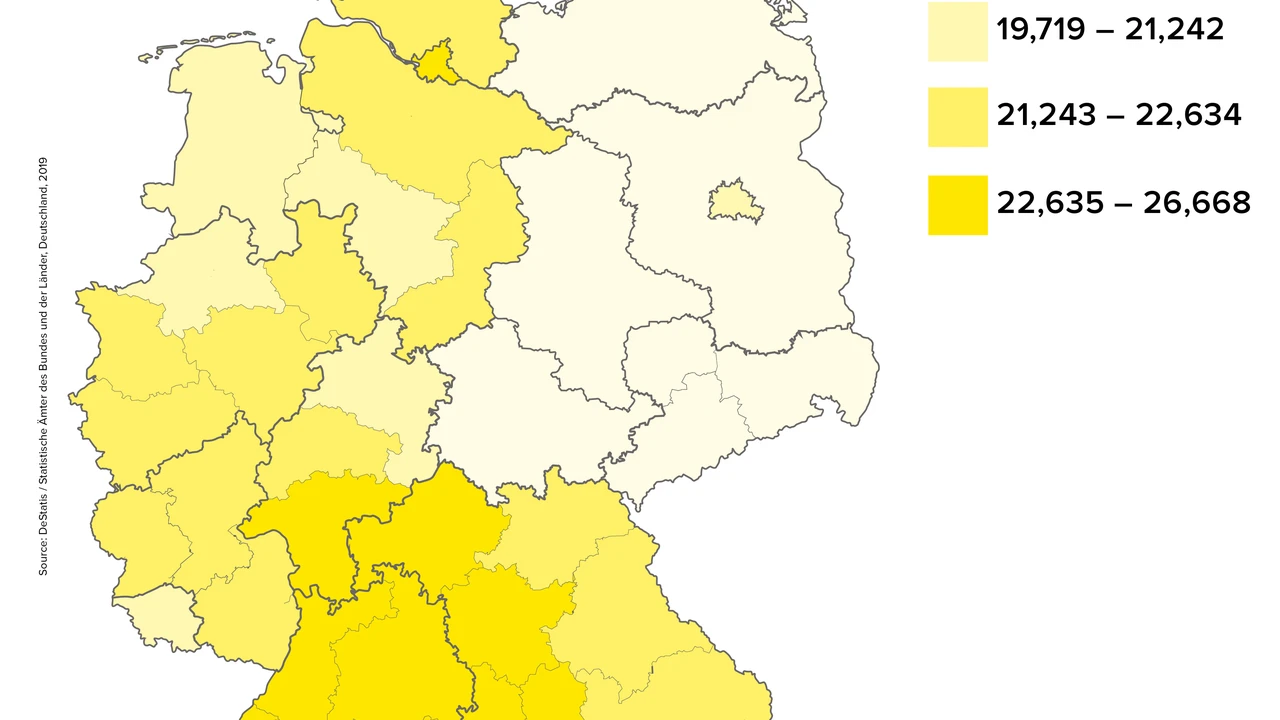

- Location: Where you live matters. Urban areas with higher traffic density and crime rates typically have higher insurance premiums than rural areas.

- Coverage Levels: The amount of coverage you choose (liability, collision, comprehensive, etc.) directly impacts the premium. Higher coverage limits mean higher costs.

- Deductibles: The deductible is the amount you pay out-of-pocket before the insurance company kicks in. Higher deductibles usually result in lower premiums, but you'll have to pay more if you file a claim.

- Good Student Discounts: As you already know from the article title, maintaining good grades can unlock significant discounts. More on that later!

Essentially, insurance companies are trying to predict how likely you are to file a claim and how much that claim will cost. The more risky factors you have, the higher your premium will be.

Exploring Affordable Teen Driver Insurance Options Finding the Best Rates

Okay, so teen driver insurance is expensive. But don't despair! There are ways to find more affordable options. Here's a breakdown of strategies you can use:

- Shop Around: This is the most crucial step. Don't just settle for the first quote you get. Get quotes from multiple insurance companies and compare them carefully. Online quote comparison tools can be a great starting point.

- Increase Deductibles: As mentioned earlier, raising your deductible can lower your premium. Just make sure you can comfortably afford to pay that deductible if you need to file a claim.

- Consider a Usage-Based Insurance Program: Some insurance companies offer programs that track your driving habits using a mobile app or device installed in your car. Safe driving can earn you significant discounts.

- Look for Discounts: Besides good student discounts, explore other potential discounts, such as multi-car discounts, safe driver discounts, and discounts for completing a defensive driving course.

- Stay on Your Parent's Policy: If possible, having your teen driver added to your existing policy is usually cheaper than getting them their own separate policy.

- Choose a Safe Vehicle: As mentioned before, the type of car matters. Opt for a vehicle with good safety ratings and features like anti-lock brakes and electronic stability control.

- Maintain a Clean Driving Record: This is the most important long-term strategy. Avoid accidents, tickets, and violations. A clean driving record will pay off in the long run.

Remember, finding affordable insurance is about being proactive and exploring all your options. Don't be afraid to negotiate and ask for discounts.

Good Student Discounts How Grades Can Lower Your Insurance Premiums

Let's dive deeper into the magical world of good student discounts! This is a fantastic way for teens to lower their insurance costs, and it rewards academic achievement. Here's what you need to know:

Most insurance companies offer good student discounts to students who meet certain academic requirements. Typically, this means maintaining a B average or better, being in the top 20% of your class, or achieving a certain score on standardized tests. The specific requirements vary by company, so it's important to check with each insurer.

The amount of the discount can range from a few percentage points to as much as 25% or more! That can add up to significant savings over the course of a year.

To qualify for a good student discount, you'll usually need to provide proof of your academic achievement, such as a report card or transcript. The discount typically lasts until you turn 25 or graduate from college, whichever comes first.

So, encourage your teen to hit the books! Good grades not only lead to better opportunities in life but also lower insurance premiums.

Comparing Teen Driver Insurance Companies Recommendations and Reviews

Now, let's get down to the nitty-gritty: which insurance companies offer the best deals for teen drivers? Here are a few recommendations, along with some pros and cons:

- [Insurance Company A]: Known for its competitive rates and wide range of discounts, including good student discounts and safe driver discounts. They also offer usage-based insurance programs.

- Pros: Competitive rates, numerous discounts, usage-based insurance options, good customer service.

- Cons: Rates can fluctuate based on driving habits, some complaints about claim processing times.

- [Insurance Company B]: Offers excellent customer service and a variety of coverage options, including accident forgiveness.

- Pros: Excellent customer service, accident forgiveness, comprehensive coverage options.

- Cons: Can be more expensive than other companies, limited availability in some states.

- [Insurance Company C]: A well-known brand with a strong financial rating and a user-friendly website.

- Pros: Strong financial rating, user-friendly website, nationwide availability.

- Cons: Rates can be higher for teen drivers, limited discounts.

Important Note: These are just a few examples, and the best insurance company for you will depend on your specific circumstances. Be sure to get quotes from multiple companies and compare them carefully.

Specific Products and Usage Scenarios Real-World Examples

Let's look at some specific insurance products and how they might be used in real-world scenarios.

- Liability Coverage: This is the most basic type of insurance and is required in most states. It covers damages you cause to others in an accident, including bodily injury and property damage.

- Scenario: Your teen rear-ends another car. Liability coverage will pay for the damage to the other car and any injuries sustained by the other driver and passengers.

- Collision Coverage: This covers damage to your own car in an accident, regardless of who is at fault.

- Scenario: Your teen hits a tree. Collision coverage will pay for the repairs to your car, minus your deductible.

- Comprehensive Coverage: This covers damage to your car from things other than accidents, such as theft, vandalism, fire, and natural disasters.

- Scenario: Your teen's car is stolen. Comprehensive coverage will pay for the replacement of the car, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This covers your medical bills and other expenses if you're hit by an uninsured or underinsured driver.

- Scenario: Your teen is hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your expenses. Uninsured/Underinsured Motorist coverage will pay for your medical bills and other expenses.

Choosing the right coverage levels is crucial. You want to make sure you have enough coverage to protect yourself financially in the event of an accident, but you also don't want to overpay for coverage you don't need.

Product Comparisons Costs and Features

Let's compare some specific insurance products from different companies, focusing on costs and features. Remember, these are just examples, and actual prices will vary based on your individual circumstances.

Example 1: Liability Coverage (State Minimum)

- [Insurance Company A]: $[Price] per month

- [Insurance Company B]: $[Price] per month

- [Insurance Company C]: $[Price] per month

Example 2: Full Coverage (Liability, Collision, Comprehensive) with $[Deductible Amount] Deductible

- [Insurance Company A]: $[Price] per month

- Features: Accident Forgiveness (after 5 years of safe driving), Roadside Assistance

- [Insurance Company B]: $[Price] per month

- Features: Diminishing Deductible (deductible decreases over time with safe driving), Gap Insurance

- [Insurance Company C]: $[Price] per month

- Features: Usage-Based Insurance Program (potential for significant discounts based on driving habits), Mobile App for claims and policy management

Important Considerations:

- Price is not the only factor. Consider the features and benefits offered by each company, as well as their customer service reputation.

- Read the fine print. Understand the terms and conditions of your policy, including any exclusions or limitations.

- Shop around regularly. Insurance rates can change over time, so it's a good idea to shop around for new quotes every year or two.

The Impact of Location on Teen Driver Insurance Rates Urban vs Rural

Where you live plays a significant role in determining your teen driver insurance rates. Urban areas generally have higher rates than rural areas, and here's why:

- Traffic Density: Urban areas have higher traffic density, which increases the risk of accidents.

- Crime Rates: Urban areas often have higher crime rates, which increases the risk of theft and vandalism.

- Population Density: Higher population density means more pedestrians and cyclists, which increases the risk of accidents involving these vulnerable road users.

- Repair Costs: Repair costs tend to be higher in urban areas due to higher labor rates and parts costs.

If you live in an urban area, you can expect to pay more for teen driver insurance than if you live in a rural area. However, you can still take steps to lower your rates, such as choosing a safe vehicle, maintaining a clean driving record, and taking advantage of discounts.

Safe Driving Habits and Their Effect on Insurance Costs

Developing and maintaining safe driving habits is crucial for lowering your insurance costs and, more importantly, for staying safe on the road. Here are some key safe driving habits:

- Avoid Distractions: Put away your phone, avoid eating or drinking while driving, and focus on the road.

- Obey Traffic Laws: Follow speed limits, traffic signals, and other traffic laws.

- Drive Defensively: Be aware of your surroundings and anticipate potential hazards.

- Maintain Your Vehicle: Regularly check your tires, brakes, and other important components.

- Don't Drive Under the Influence: Never drive under the influence of alcohol or drugs.

- Get Enough Sleep: Drowsy driving is dangerous. Make sure you're well-rested before getting behind the wheel.

Insurance companies often reward safe driving habits with discounts, such as safe driver discounts and usage-based insurance discounts. By practicing safe driving, you can lower your insurance costs and protect yourself and others on the road.

Understanding Different Types of Coverage Liability Collision Comprehensive

We've touched on this before, but let's really nail down the different types of coverage to make sure you understand what each one covers.

* **Liability Coverage:** This is the most basic and often legally required coverage. It pays for damages you cause to others if you're at fault in an accident. This includes bodily injury and property damage. * **Collision Coverage:** This pays for damage to your vehicle if you collide with another object, regardless of who's at fault. This includes accidents with other cars, trees, or even potholes. * **Comprehensive Coverage:** This covers damage to your vehicle from events other than collisions. This includes theft, vandalism, fire, hail, and other natural disasters. * **Uninsured/Underinsured Motorist Coverage:** This protects you if you're hit by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages. * **Medical Payments Coverage (MedPay):** This pays for your medical expenses if you're injured in an accident, regardless of who's at fault.Choosing the right combination of coverage is essential for protecting yourself financially. Talk to your insurance agent to determine the best coverage levels for your needs.

The Role of Credit Score in Teen Driver Insurance (If Applicable in Your State)

In some states, insurance companies are allowed to use credit scores to determine insurance rates. A lower credit score can result in higher premiums, while a higher credit score can result in lower premiums. This is because insurance companies believe that people with lower credit scores are more likely to file claims.

If you live in a state where credit scores are used, it's important to maintain a good credit score to lower your insurance costs. You can improve your credit score by paying your bills on time, keeping your credit card balances low, and avoiding unnecessary debt.

However, many states have banned or restricted the use of credit scores in insurance pricing. Check your state's regulations to see if this applies to you.

Defensive Driving Courses Are They Worth It

Taking a defensive driving course can be a great way to improve your driving skills, lower your insurance costs, and even dismiss traffic tickets. These courses teach you how to anticipate potential hazards, avoid accidents, and drive safely in various conditions.

Many insurance companies offer discounts to drivers who complete a defensive driving course. The amount of the discount can vary, but it's often worth the time and effort to take the course.

In some states, you may be required to take a defensive driving course to dismiss a traffic ticket. This can help you avoid points on your driving record and prevent your insurance rates from increasing.

Defensive driving courses are typically offered online or in person. They usually take a few hours to complete and cover a variety of topics, such as:

* Traffic laws and regulations * Safe driving techniques * Hazard recognition * Accident avoidance * Driving under the influenceIf you're looking to improve your driving skills, lower your insurance costs, or dismiss a traffic ticket, a defensive driving course may be a good option for you.

Telematics and Usage Based Insurance Programs How They Work and Can Save Money

Telematics and usage-based insurance (UBI) programs are becoming increasingly popular as a way to save money on car insurance. These programs use technology to track your driving habits and reward safe driving with discounts.

Here's how they work:

* **Data Collection:** A device (either a smartphone app or a plug-in device) tracks your driving behavior, including things like speed, acceleration, braking, and mileage. * **Data Analysis:** The insurance company analyzes the data to assess your driving risk. * **Discount Application:** Based on your driving score, you may be eligible for discounts on your insurance premiums.The benefits of UBI programs include:

* **Potential Savings:** Safe drivers can save significant money on their insurance premiums. * **Improved Driving Habits:** The feedback provided by UBI programs can help you improve your driving habits and become a safer driver. * **Fairer Pricing:** UBI programs can provide a more accurate assessment of your driving risk than traditional insurance methods.However, there are also some potential drawbacks to consider:

* **Privacy Concerns:** Some drivers may be concerned about sharing their driving data with insurance companies. * **Potential for Higher Rates:** If you have poor driving habits, you may end up paying more for insurance. * **Technology Issues:** UBI programs rely on technology, which can be prone to glitches and errors.If you're considering a UBI program, be sure to weigh the pros and cons carefully. Read the terms and conditions of the program to understand how your data will be used and how your rates will be affected.

The Importance of Regular Insurance Reviews Ensuring Adequate Coverage

It's important to review your insurance coverage regularly to ensure that it still meets your needs. Life changes, such as getting married, buying a home, or having a child, can impact your insurance needs.

Here are some things to consider when reviewing your insurance coverage:

* **Coverage Limits:** Make sure your coverage limits are high enough to protect you financially in the event of a serious accident. * **Deductibles:** Consider whether your deductibles are still appropriate for your budget. * **Discounts:** Check to see if you're eligible for any new discounts. * **Life Changes:** Update your policy to reflect any life changes, such as a new address, a new car, or a new family member.It's a good idea to review your insurance coverage at least once a year or whenever you experience a major life change. Talk to your insurance agent to get personalized advice and ensure that you have the right coverage for your needs.

Negotiating with Insurance Companies Tips and Strategies

Don't be afraid to negotiate with insurance companies to get the best possible rates. Here are some tips and strategies to use:

* **Shop Around:** Get quotes from multiple insurance companies and compare them carefully. * **Ask for Discounts:** Inquire about all available discounts, such as good student discounts, safe driver discounts, and multi-policy discounts. * **Increase Your Deductible:** Raising your deductible can lower your premium. * **Bundle Your Policies:** Combining your auto insurance with your home insurance can often result in significant savings. * **Negotiate Your Coverage Limits:** Adjust your coverage limits to meet your needs and budget. * **Be Polite and Professional:** Treat the insurance agent with respect and be prepared to explain your situation clearly. * **Don't Be Afraid to Walk Away:** If you're not happy with the rates you're being offered, don't be afraid to walk away and try another company.Understanding State Specific Insurance Laws and Regulations

Insurance laws and regulations vary from state to state. It's important to understand the laws in your state to ensure that you have the right coverage and are complying with all legal requirements.

Here are some things to consider:

* **Minimum Coverage Requirements:** Each state has minimum coverage requirements for auto insurance. Make sure you meet these requirements. * **No-Fault vs. At-Fault States:** Some states are no-fault states, which means that your own insurance company will pay for your medical expenses, regardless of who is at fault in an accident. Other states are at-fault states, which means that the at-fault driver's insurance company will pay for your medical expenses. * **Uninsured Motorist Coverage:** Some states require uninsured motorist coverage, while others do not. * **Other State-Specific Laws:** Be aware of any other state-specific laws that may affect your insurance coverage.You can find information about your state's insurance laws and regulations on your state's Department of Insurance website.

The Future of Teen Driver Insurance Emerging Technologies and Trends

The future of teen driver insurance is likely to be shaped by emerging technologies and trends, such as:

* **Advanced Driver-Assistance Systems (ADAS):** ADAS technologies, such as automatic emergency braking and lane departure warning, can help prevent accidents and lower insurance costs. * **Autonomous Vehicles:** As autonomous vehicles become more common, the role of human drivers in accidents will decrease, which could lead to lower insurance rates. * **Big Data and Analytics:** Insurance companies are using big data and analytics to better assess risk and personalize insurance rates. * **Mobile Technology:** Mobile technology is being used to track driving habits, provide feedback to drivers, and facilitate claims processing. * **Subscription-Based Insurance:** Subscription-based insurance models are becoming increasingly popular, offering drivers more flexibility and control over their coverage.These emerging technologies and trends have the potential to make teen driver insurance more affordable, personalized, and effective.

Resources for Finding Affordable Teen Driver Insurance

Finding affordable teen driver insurance can be challenging, but there are many resources available to help you. Here are some useful resources:

* **Online Quote Comparison Tools:** These tools allow you to get quotes from multiple insurance companies in one place. * **Insurance Company Websites:** Visit the websites of individual insurance companies to get quotes and learn more about their products and services. * **Independent Insurance Agents:** Independent insurance agents can help you compare quotes from multiple companies and find the best coverage for your needs. * **State Department of Insurance Websites:** These websites provide information about insurance laws and regulations in your state. * **Consumer Advocacy Groups:** These groups can provide information and resources to help you make informed decisions about insurance.Frequently Asked Questions About Teen Driver Insurance

Here are some frequently asked questions about teen driver insurance:

* **How much does teen driver insurance cost?** The cost of teen driver insurance varies depending on a number of factors, such as age, driving record, type of vehicle, and location. * **How can I save money on teen driver insurance?** There are several ways to save money on teen driver insurance, such as getting good grades, taking a defensive driving course, and shopping around for quotes. * **What types of coverage do I need?** The types of coverage you need will depend on your individual circumstances. Talk to your insurance agent to get personalized advice. * **What is a deductible?** A deductible is the amount you pay out-of-pocket before the insurance company pays for a claim. * **What is a good student discount?** A good student discount is a discount offered to students who maintain good grades.I hope this information has been helpful! Remember to do your research and shop around to find the best teen driver insurance for your needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)