Teen Driver Insurance and Defensive Driving Courses

Understanding the Basics of Teen Driver Insurance and How Defensive Driving Courses Can Help

Alright, let's talk teen driver insurance. It's a subject that can make any parent's wallet cringe, but it's a necessary evil, right? The good news is, you're not alone in this. Figuring out the best way to insure your teen driver is a common puzzle. And one piece of that puzzle is often overlooked: defensive driving courses. We're going to break it all down, from the sky-high premiums to how a simple course can save you some serious cash.

Why is Teen Driver Insurance So Expensive A Deep Dive into the Risks

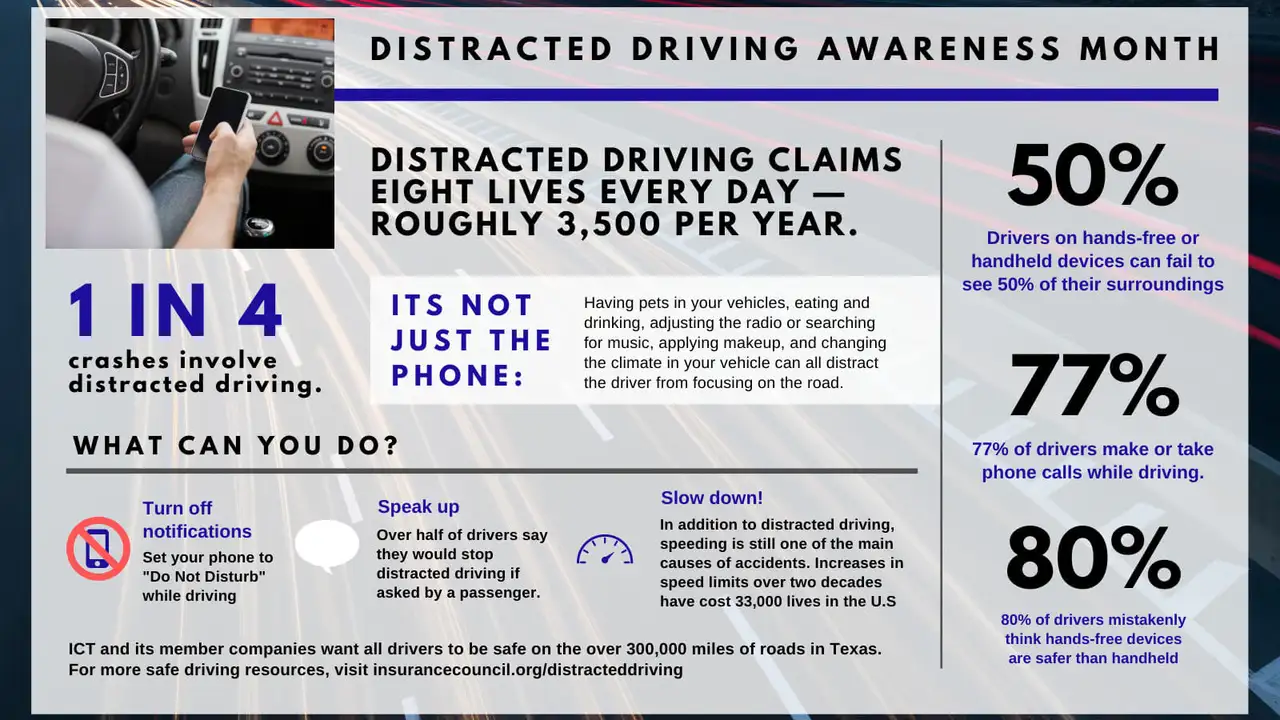

So, why the crazy prices? It boils down to risk. Statistically, teen drivers are more likely to be involved in accidents than older, more experienced drivers. Think about it: less experience behind the wheel, maybe a little more distracted by friends or phones (we've all been there!), and a generally higher tendency to take risks. Insurance companies see all this data and adjust their rates accordingly. They're not trying to rip you off (okay, maybe a little!), they're simply hedging their bets. This higher risk translates directly into higher premiums for you.

Here's a few of the factors contributing to the cost:

- Lack of Experience: This is the big one. Inexperience leads to more errors and slower reaction times.

- Distracted Driving: Phones, friends, food… teens have a lot vying for their attention in the car.

- Risk-Taking Behavior: Let's be honest, sometimes teenagers aren't the best at judging risk. Speeding, reckless driving... it all adds up.

- Vehicle Type: The type of car your teen drives also matters. A sporty, high-performance car will cost more to insure than a safe, reliable sedan.

Defensive Driving Courses The Secret Weapon for Lowering Insurance Premiums

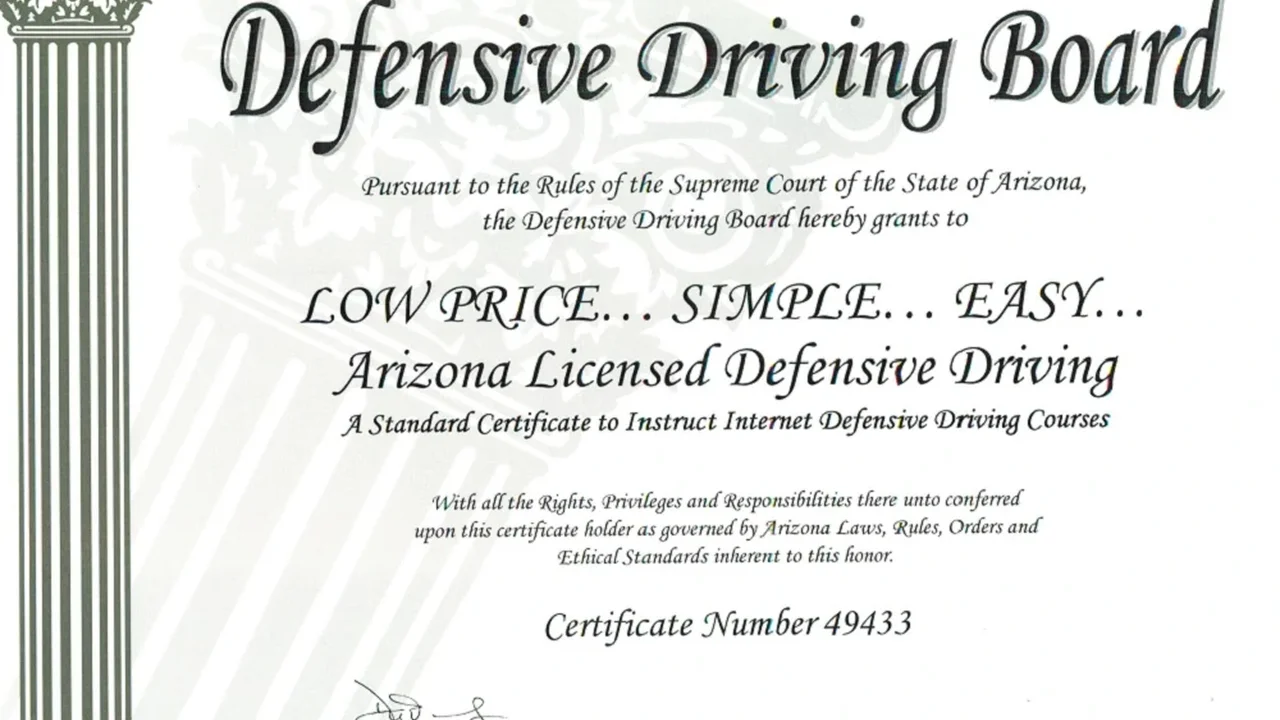

Now for the good news! Defensive driving courses can be a game-changer. These courses teach teens (and adults, for that matter) safe driving habits, hazard perception, and accident avoidance techniques. By completing a course, your teen demonstrates a commitment to safe driving, which can significantly lower your insurance premiums. Think of it as proving to the insurance company that your teen is a safer bet.

How it works: Your teen takes a state-approved defensive driving course (online or in person), passes the test, and provides proof of completion to your insurance company. The insurance company then applies a discount to your premium. It's that simple!

Choosing the Right Defensive Driving Course A Guide to Finding the Best Option for Your Teen

Not all defensive driving courses are created equal. You'll want to make sure the course is state-approved and covers the necessary topics. Here's what to look for:

- State Approval: This is crucial. Make sure the course is approved by your state's DMV or equivalent agency. Otherwise, it won't count towards an insurance discount.

- Course Content: The course should cover topics like safe driving techniques, hazard perception, accident avoidance, and the dangers of distracted driving.

- Course Format: Online courses are convenient and flexible, while in-person courses offer a more interactive learning experience. Choose the format that best suits your teen's learning style.

- Cost: Course costs vary, so shop around and compare prices. Remember, the cost of the course is often offset by the insurance discount.

Beyond the Discount The Additional Benefits of Defensive Driving Education

While the insurance discount is a major perk, defensive driving courses offer benefits that extend far beyond just saving money. They can help your teen become a safer, more responsible driver, which is priceless. Here are some additional benefits:

- Improved Driving Skills: Teens learn valuable driving techniques that can help them avoid accidents.

- Increased Awareness: Defensive driving courses teach teens to be more aware of their surroundings and potential hazards.

- Better Decision-Making: Teens learn to make better decisions behind the wheel, such as avoiding distractions and driving defensively.

- Reduced Risk of Accidents: Ultimately, the goal is to reduce the risk of accidents and keep your teen safe.

Teen Driver Insurance Products Compared Exploring Different Coverage Options and Pricing

Okay, let's talk about specific insurance products. Choosing the right coverage can be confusing, so let's break down some common options:

- Liability Coverage: This is the minimum coverage required by law in most states. It covers damages and injuries you cause to others in an accident. While it's the cheapest option, it doesn't protect you if you're at fault.

- Collision Coverage: This covers damage to your car if you're involved in an accident, regardless of who's at fault. It's more expensive than liability coverage, but it provides more protection.

- Comprehensive Coverage: This covers damage to your car from things other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by someone who doesn't have insurance or doesn't have enough insurance to cover your damages.

Product Examples and Comparisons:

(Note: Actual prices will vary depending on your location, your teen's driving record, and other factors. These are just examples.)

State Farm Drive Safe & Save: This program uses a mobile app to track your teen's driving habits and offers discounts for safe driving. It's a great option for tech-savvy teens who are willing to be monitored. Estimated cost: $200 - $400 per month for full coverage with Drive Safe & Save discount.

Allstate Milewise: This is a pay-per-mile insurance program. You pay a base rate plus a per-mile rate, which can be a good option if your teen doesn't drive much. Estimated cost: Base rate of $50 per month plus $0.10 per mile.

Progressive Snapshot: Similar to State Farm's Drive Safe & Save, Snapshot tracks your teen's driving habits and offers discounts for safe driving. It's a good option if you're looking for a straightforward way to save money. Estimated cost: Variable, depends heavily on driving habits tracked.

Geico: Geico offers a variety of discounts for teen drivers, including discounts for good students, defensive driving courses, and having safety features in the car. Estimated cost: $250 - $450 per month for full coverage, depending on discounts.

Usage Scenarios:

- Low Mileage Driver: Allstate Milewise is a good choice.

- Safe Driver (Willing to be Monitored): State Farm Drive Safe & Save or Progressive Snapshot are excellent.

- Good Student: Geico often offers significant discounts.

- Budget-Conscious: Compare quotes from multiple insurers to find the best price.

Price Comparison Table (Example):

| Insurance Company | Product | Estimated Monthly Cost (Full Coverage) | Key Features |

|---|---|---|---|

| State Farm | Drive Safe & Save | $250 (with discount) | Mobile app tracking, discounts for safe driving |

| Allstate | Milewise | $50 (base) + $0.10/mile | Pay-per-mile insurance |

| Progressive | Snapshot | Variable (depends on driving) | Mobile app tracking, personalized rates |

| Geico | Standard Policy | $350 (with good student discount) | Variety of discounts, reliable coverage |

The Importance of Shopping Around Getting Multiple Quotes to Find the Best Deal

Don't settle for the first quote you get! Insurance rates vary widely from company to company, so it's crucial to shop around and compare quotes from multiple insurers. Use online comparison tools or contact independent insurance agents to get quotes from different companies. You might be surprised at how much you can save.

Tips for Saving Money on Teen Driver Insurance Beyond Defensive Driving

Defensive driving courses are a great start, but there are other ways to lower your insurance premiums:

- Good Student Discount: Many insurance companies offer discounts for students with good grades.

- Safety Features: Cars with safety features like anti-lock brakes, airbags, and electronic stability control often qualify for discounts.

- Increase Deductibles: Increasing your deductible (the amount you pay out-of-pocket before insurance kicks in) can lower your premium.

- Bundle Policies: If you have other insurance policies (home, auto, etc.) with the same company, you may be able to get a discount for bundling.

- Stay on Parents' Policy: It's usually cheaper to add your teen to your existing policy than to get them their own separate policy.

The Long-Term Benefits of Safe Driving Habits For Teens and Their Wallets

Ultimately, the best way to save money on teen driver insurance is to encourage safe driving habits. Not only will this lower your insurance premiums, but it will also keep your teen safe on the road. Talk to your teen about the dangers of distracted driving, speeding, and reckless driving. Set a good example by driving safely yourself. And remember, safe driving is an investment in your teen's future.

So there you have it! Teen driver insurance can be a pain, but with a little research and some smart planning, you can find ways to save money and keep your teen safe. Good luck!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)